Here we are, three years into what began as an experiment — sales of recreational cannabis in Colorado and Washington — and now is more like the march of history as other states begin legalizing recreational cannabis.

Between Colorado, Washington and Oregon we now have a wealth of data to help us understand quite a bit about consumer and retail trends.

While concentrates and edibles are rising in popularity in all three states, flower remains the No. 1 engine of cannabis sales there. The three states have sold $2.67 billion in flower between January 2014 (when Colorado began recreational sales) and September 2016, which represents 63 percent of all cannabis sales during the period.

“Flower” is a broad term that embraces a wide variety of products; at BDS Analytics, more than 3,000 strain names are tracked.

We analyzed general flower trends in Colorado, Washington and Oregon, and found that while consumers in different markets resemble one another in terms of what types of flower they are buying, they also exhibit flashes of independence.

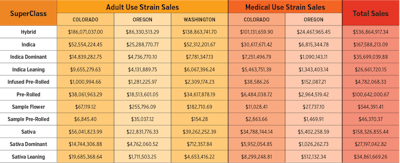

Consumers shopping within all five channels — Colorado Adult Use; Colorado Medical; Oregon Adult Use; Oregon Medical; Washington Adult Use — prefer straight hybrids over other tracked types: indica, indica-dominant, sativa and sativa-leaning.

Oregon medical buyers are the most enthusiastic buyers of straight hybrids; the category has commanded 56 percent of flower sales in that market through September 2016.

In the Colorado Adult Use market, straight hybrids don’t even account for half of all flower sales; the category represented 47 percent of sales in 2015. However, this is an increase from 2014, when straight hybrids commanded just 43 percent of the Adult Use market.

Of the three states, Washington is the most fond of indica, where it represents 18 percent of flower sales through September 2016. Interest in indica has slightly declined in 2016 from 2015, when indicas held 22 percent of the market. Shoppers in Colorado’s Adult Use channel are the least enthusiastic about indicas, representing just 13 percent of that market's sales, putting it behind sativa.

In fact, Colorado’s two channels are the only ones that prefer sativa slightly over indica: Adult Use (14 percent sativa to 13 percent indica), and Medical (17 percent sativa to 15 percent indica).

Meanwhile, shoppers in Oregon’s Medical channel buy enough sativa to capture just 12 percent of that market, making that market the least enthusiastic about sativa.