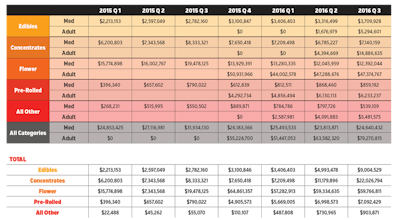

Oregon’s medical marijuana market garnered $110 million in retail sales in 2015, according to data compiled by BDS Analytics. Based on information collected from its proprietary panel of Oregon dispensaries, BDS estimates the medical market increased steadily from $25 million in the first quarter of 2015 to $32 million in the third. Sales fell back to $26 million in the fourth quarter when adult-use sales began and accounted for $55 million at retail, BDS data show.

“The advent of adult-use sales in October 2015 boosted total cannabis sales in Oregon,” says Tom Jones, director of analytics at Boulder, Colo.-based BDS Analytics. “But adult use also put a clear dent in medical sales.”

Until now, Oregon adult-use sales in 2015 and Oregon medical cannabis sales, in general, have been the subject of speculation with no reliable numbers due to the fact that cannabis taxation did not start in Oregon until January 2016. (Medical marijuana in Oregon still is not taxed.) Tax numbers from the state have been the primary source of information from which analysts have projected adult-use dispensaries’ total sales. But data that its panel of retailers provides to BDS allows the firm to extrapolate untaxed cannabis sales as well.

As adult-use dispensaries picked up steam, medical marijuana sales continued to decline in 2016, falling from $25.5 million in the first quarter to approximately $24.6 million in the third.

Over that same period, adult-use sales grew from $51 million in the first quarter to $79 million in the third. Adult-use sales surged in June when the channel began selling cannabis-infused edibles and concentrates under the state’s early start program. Prior to June, regulations restricted adult-use dispensaries to flower and pre-rolled offerings.

In June, the adult-use channel sold $4.4 million worth of concentrates. That compares to the medical channel’s average $2.5 million per month over the preceding 12 months. The story is similar with edibles: In the first month of adult-use sales, the channel grossed $1.7 million, whereas medical averaged $1 million per month in the preceding year.

Flower sales suffered somewhat with the introduction of adult-use concentrates and edibles, declining 1.2 percent ($0.2 million) from May to June. Flower sales remained near that level in September. From May to June, concentrates sales increased 201 percent (from $2.2 million to $6.5 million). September concentrate sales were $7.2 million, a $700,000 increase over June.