There’s no doubt that Samuel Adams and its parent company, Boston Beer, are pioneers in the craft beer industry. The evidence: the Massachusetts-based brand helped bring the craft industry into the mainstream, became a mainstay at barbecues and sporting events throughout the Northeast U.S. and ranked second in total sales among craft beer brands in 2017, according to data collected by Statista.

Now, another Massachusetts company is trying to set craft standards—this time for the cannabis industry.

Theory Wellness, a vertically integrated cannabis business with medical locations in Bridgewater and Great Barrington, Mass., is one of the few—if not the only—medical cannabis companies that grows what CEO Brandon Pollock calls “small-batch” cannabis.

Looking to craft beer successes such as Samuel Adams, Pollock sees three significant similarities with what his company is trying to do: limited batches, a local distribution chain and, above all, a premium on quality. He hopes that by going the craft route, Theory Wellness will distinguish itself and avoid the race to the bottom in pricing like the one many West Coast markets are experiencing.

“Our goal in the adult-use market is to ... produce a unique, premium product for folks that may not be consuming every day and want to have the best experience possible,” Pollock says.

Theory’s medical patients will still benefit from affordably priced products, though, thanks to the company’s large selection and price points, as well as the state’s requirement that all medical dispensaries offer discounts to patients with financial hardships. Although the state does not specify what the discount should be, Pollock’s company offers 20-percent off purchases to qualifying patients.

“If you’re on state health insurance, you qualify; if you’re on social security insurance, you qualify; if your income falls below certain categories, [we] can offer tiered discounts,” Pollock says. In addition to low-income patients, Theory Wellness extends that rebate to veterans. As a courtesy, the discount is automatically given to customers when they mention their financial hardship or military status, with documentation required on the second visit to register them in the system.

Ultimately, the company’s goal is to consistently produce high-quality craft cannabis for medical patients and the discerning recreational consumer when the adult-use market launches July 1. To get there, Pollock is looking toward long-practiced cultivation techniques.

Perfecting the Recipe

Theory Wellness isn’t looking to revolutionize cannabis cultivation, Pollock says. High-pressure sodium (HPS) lights hover above the canopy as the roots rest in a coco coir blend because those are the inputs with which Theory’s growers, who have cultivation backgrounds from Maine’s medical program, are most familiar.

“Part of our drive here at Theory is to, at this point in time, not reinvent the wheel,” Pollock says. “Right now, we’re keeping it simple.”

Keeping it simple has its benefits, especially when it comes to compliance. Massachusetts has comprehensive downstream testing requirements (heavy metal, pesticide, yeast/mold), so by utilizing a sterile input like coco coir, instead of soil (which has a greater risk for contaminants), Pollock’s team can ensure compliance more reliably, he says.

Additionally, this simplified and familiar approach also allows the cultivation team to focus on the plants instead of learning how to operate new equipment or creating new standard operating procedures (SOPs) with which to train the staff. This way, the lead cultivator sees the plants every day, Pollock explains.

“The conventional head grower has a tough responsibility where [he/she is] supposed to be managing cultivation teams, setting people’s schedules, but also be managing plants,” he says. With only 6,000 square feet of canopy, the cultivation staff doesn’t need as much oversight. That said, Pollock says it’s important that employees have assigned responsibilities.

“Clearly defining people’s roles is important—and giving people autonomy,” he says. “If you’re the lead of the cultivation side for plant health, we’re going to trust you to make your own decisions.”

Pollock realizes scaling is difficult as the company expands and is considering what workflow tweaks he wants to test before the canopy footprint grows. To do that, he’s relying heavily on all the data his smaller facility allows him to analyze. “We’re obsessed with collecting data,” the CEO says. “Having a smaller harvest size—a smaller facility—gives us more opportunity to test and examine” by having to put less time into plant scouting and watering.

The Theory Wellness team looks for ways to make cultivation improvements through incremental changes. Pollock says a common mistake cultivators make is changing multiple variables at once instead of replacing one input at a time to determine which tweak results in the best outcome. Since its first crop, Theory Wellness has tested small adjustments to nutrients, water temperature and the growing environment—and has tailored every variable for each variety it cultivates. The recipe is tweaked until the team is confident with both the quality and the consistency.

The ability to make cultivation decisions swiftly is a luxury afforded to smaller grows like Theory Wellness, which do not have 100,000 square feet or more of canopy to adjust. It’s also a luxury that comes in handy when launching a cultivation business 100-percent from seed.

Starting from Scratch

When they were ready to roll out the newest cannabis regulations in 2014, Massachusetts regulators stated no clones or clippings could be used to get a cultivation business up and running. Everything within the facility had to be popped from seed.

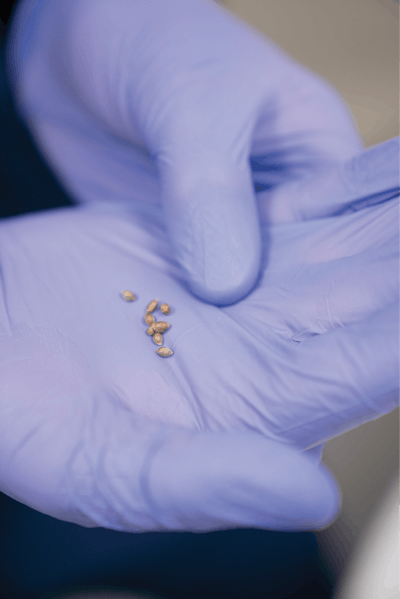

That first harvest was difficult for Theory Wellness, but, Pollock says, “I think we did as good as we could have, considering those circumstances.” The first seed-related challenge the company faced was the science of probability: Roughly half of any batch of seeds will produce male plants. This posed two problems. First, Pollock did not want to spend half his resources (labor, nutrients, energy) on nurturing plants that would be unceremoniously uprooted and destroyed. Second, he didn’t want those male plants to mature and ruin his sinsemilla crop by pollinating it.

To minimize the risk of either scenario becoming a reality, Pollock partnered with one of the state’s licensed testing labs to test plant tissue to determine sex. “After two weeks, we were able to run those tests and cull out all the males,” he says, adding that paying for genetic testing is better “than looking for the signs on the plants.”

The second challenge was hermaphroditism. Whenever you start a large crop from seed, you’re going to get a wide range of phenotypes, Pollock explains. That includes expressions you want to eliminate quickly, like pollen-producing hybrids. But scouting for hermaphroditic plants is an arduous task, as sometimes a single branch can contain pollen and put your entire crop at risk.

“We had to have our cultivation team looking at every single plant, every single day, looking for any signs that there could be pollen being produced,” Pollock says. Despite its best efforts, however, Theory Wellness did lose part of its first crop to seed.

“It’s almost inevitable when you’re starting thousands of seeds that you’re going to have a little bit of pollen that gets created in that process when you’re in flower,” he continues. “That was an ongoing challenge as we narrowed down our phenotypes to make sure we weren’t getting any seeds in our crops.”

Pollock says his director of cultivation has an eye for genetics, adding, “He really is responsible for the curation of those seeds.” The approach the company takes is straightforward: Look to the past to predict the future.

“Something we pride ourselves on is not just keeping our eye on the trends, but also looking at what was popular 10 years ago and reintroduce that into the market,” Pollock says. “In cannabis, trends move really quick, but that sometimes leaves behind some really great genetics that were really popular for a reason and then weren’t the ‘flavor of the month’ anymore, but they still have great attributes.”

With more than a year’s experience curating its genetics and phenotypes, Theory Wellness has finally grown out of its seeding woes. “Now that we’ve been able to narrow down our pheno selections, things have been a lot smoother on that end.”

Unique Flavors for Local Needs

This approach to genetic selection—searching for what history overlooked—has allowed the company to distinguish itself from other cultivators offering more of the bestsellers, such as OG Kush and Blue Dream. Theory Wellness’ Bridgewater menu currently hosts 11 flower varieties in pre-rolled and packaged form, including eclectic selections like Star-flight Guava (a sativa hybrid), Soul Mate (hybrid) and Kimbo Kush (indica). “We try to promote the new, the old and the not-really-been-promoted-yet at our facility,” Pollock says.

That’s because he has seen a narrowing of the gene pool in cannabis varieties over the past several years. And he’s not wrong: Even a cursory glance at Phylos Bioscience’s Galaxy (a digital 3-D visualization of cannabis DNA sequence data) shows popular varieties such as GSC or OG Kush crossed into dozens of other genetic lines. Selling the flavor of the month might benefit a cultivator’s or a dispensary owner’s bottom line in the short term, but so much is lost when ignoring genetic diversity, Pollock says.

“Older genetics that come from a more of a landrace, a larger gene pool, can have increased vigor, increased mold resistance, and from the consumer perspective, it may remind folks what they were smoking 10 to 20 years ago.” Earthy, skunky and greasy flavors lose to today’s trend toward sweet, fruity and citrusy blends, he says, adding that while those citrusy flavors are good, “We try to have as much [of] a wide variety of flavors and effects [as possible].”

Effects are just as important as flavor to Theory Wellness. Growing genetically diverse varieties has helped the medical cannabis company address a larger pool of patient needs in his area.

“Having a wide variety of different strains with different terpene profiles allows our patients to try different products to see what works best for them,” Pollock says.

Patients still need educating on what makes those varieties so unique from one another. That education is bestowed at the point-of-sale, and Pollock highlights how his retail manager teaches staff to communicate about “how important terpenes are and how, for each individual person, different strains may be very effective or not very effective for the symptoms they are trying to offset.”

Even in the forthcoming adult-use market, the company’s emphasis will be on presenting cannabis as a wellness product, not a drug. “The whole concept of medical versus recreational or adult-use … creates an arbitrary line that doesn’t help us in the cannabis industry,” Pollock says of Theory Wellness’ philosophy.

“We have a lot of people that are looking for different reasons to use cannabis, whether it’s for marathon training, … sleep or … tremendous nerve pain. Having a wide variety of genetics … makes it easier for anyone to come into one of our dispensaries and find a product that is going to help them.”

What Now?

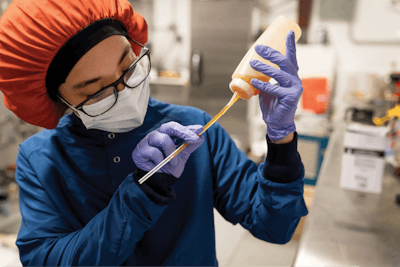

Pollock knows the company has a lot of work to do to get where it wants to be and better position itself when the recreational market opens July 1. For starters, the dispensaries will be upgraded to accommodate the anticipated increase in foot traffic, and the cultivation site is undergoing an expansion that will almost double the company’s potential output and add a tissue culture lab.

The tissue lab “should help us maintain a much larger genetic bank than if we were just working with mothers. It’s a much more conventional approach to agriculture,” Pollock describes, adding that the team is excited about the future possibilities the lab will create.

Wariness of growing too big, too fast does temper his excitement, however. Pollock says that’s one of the biggest pitfalls he has seen among cannabis companies that find early success. “A challenge that a lot of operators face right now is that you have this huge potential market, and you might have investors, or you might have yourself saying that you should blow out a 100,000-square-foot grow, right now,” Pollock says. (Massachusetts caps canopy at 100,000 square feet.)

As alluring as that scenario might be, the CEO is reticent about losing that human touch that can get lost in commercial-scale facilities. He says the company is “trying to be realistic, and not trying to expand too fast and lose our goal and our vision, which is to make sure that everything we produce is high quality.”

But the potential for the market is certainly there. At roughly 50,000 registered patients in Massachusetts, per capita participation in the medical cannabis program is fairly low. (Massachusetts has a population of roughly 6.9 million, according to data from the U.S. Census Bureau, putting the MMJ program participation rate at less than 1 percent of the population.) Come July 1, millions of consumers could join the market, and cannabis tourism should play a big role, drawing patients, enthusiasts and the curious from up and down the East Coast.

“We have proximity to many other densely populated states here in New England and New York that do not have any legal [recreational] cannabis markets, so we do expect cannabis tourism to play an effect here,” Pollock says. Projections from market research firm Brightfield Group support Pollock’s statement: 2022 forecasts project the Bay State as more than a half-billion-dollar market. (Editor’s note: For more information on East Coast market projections, see Sales Trends on p. 18.) With that in mind, the company’s chief executive predicts “a complete undersupply of cannabis in the market” when recreational sales begin, blaming a lack of infrastructure.

When Colorado’s adult-use program began, the state was home to many more established businesses in the medical market than Massachusetts has today. (Massachusetts has fewer than 20 registered medical marijuana cultivation businesses, according to state data.)

“We’re certainly behind on the infrastructure side,” Pollock says, but adds that investment has been pouring into the state at a rapid pace and that regulators are evaluating hundreds more cultivation and dispensary applications. Ultimately, Pollock remains hopeful that Massachusetts will become the cannabis hub it has the potential to be.

“The market will work itself out,” the CEO says. “We expect to be—within 18 to 24 months—the second-largest cannabis market out there behind California.”