The world is watching as more states around the nation legalize marijuana for medical and recreational purposes. The lion’s share of the West Coast has begun permitting cannabis for adult use, and it appears the Northeast-another economic behemoth with significantly more cross-border traffic-is quickly headed in the same direction.

So how will the dominoes fall on the East Coast (which market research firm Brightfield Group projects will host a $2.5-billion cannabis market by 2022)?

First Off the Line

Massachusetts: Among the two enterprising states that have led the East Coast in legalizing recreational marijuana as well as regulating its sale, Massachusetts appears to be (by far) the most likely to ramp up growth quickly and attract a great deal of cannabis-driven tourism during its first years-especially from neighboring New York. Sales are set to launch this summer after some minor regulatory setbacks.

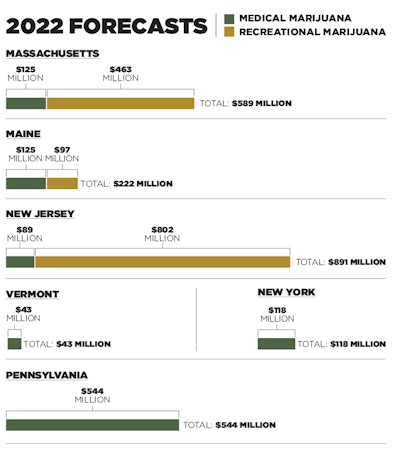

5-year market size forecast: $589 million

Maine: Though it has moved to legalize and regulate an adult-use marijuana program early (compared to other East Coast states), given Maine’s remote location, it is not expected to be a major tourist draw (especially with Canada set to legalize recreational cannabis this summer, robbing the state of more tourism revenue). Its limited population will keep the program small, and top-down delays in program implementation continue to hamper recreational growth prospects in the state.

5-year market size forecast: $222 million

Middle of the Pack

New Jersey: With a new governor who made adult-use legalization a top priority and is already working to loosen restrictions on the state’s strict medical marijuana program, New Jersey’s marijuana industry has the potential for tremendous success-particularly in the first years of a recreational program. New Jersey has a strategic location bordering New York and Pennsylvania, meaning prospects for canna-tourism are vast. However, New Jersey may become a victim of its own success, as recreational sales will likely drive New York and Pennsylvania to legalize as well, meaning tourist-rooted sales in The Garden State may not endure.

5-year market size forecast: $891 million

Vermont: The state has essentially decriminalized cannabis for adult-use, but has not yet established concrete plans for developing a regulatory structure to allow formal sales. That said, a regulatory framework looms on the horizon. When sales begin, New York residents seeking cannabis will most likely increase tourism in the state.

5-year market size forecast: $43 million

Stragglers

New York: With an extremely restrictive medical marijuana program and only vague allusions to a recreational market being uttered at this point, New York has been slow to jump on the cannabis bandwagon despite a large consumer population. These conditions most likely will drive recreational consumers and even some medical customers in search of a greater array of products without the red tape to neighboring states such as Massachusetts, New Jersey and Vermont.

5-year market size forecast: $118 million

Pennsylvania: The state has a generous list of qualifying conditions for medical marijuana patients, allows the sale of edibles and has lifted its ban on flower sales, all of which will equate to growth in the short- and medium-term. However, if New Jersey legalizes adult-use first, much of Pennsylvania’s long-term success will be swept up by residents crossing the border to New Jersey for their products.

5-year market size forecast: $544 million

New Hampshire, Connecticut, Rhode Island, Delaware: These states have made varying degrees of progress toward effective medical and recreational cannabis regulation and implementation, but none are expected to make a significant impact on the market.