Editor's note: An abbreviated version of this article ran in Hemp Grower's June 2021 print issue.

Animal feed could be a huge potential market for U.S. hemp products. With corn prices topping $6 and soybeans over $15—the highest they have been since 2013, according to PanXchange—the potential for new grain alternatives has never been greater.

Although organizations like the Hemp Feed Coalition are working diligently to clear a federally legal pathway to introduce hemp into the commercial animal feed market, it could be at least 18 months before we even get the first hempseed approval. The Association of American Feed Control Officials and the U.S. Food and Drug Administration’s Center for Veterinary Medicine (FDA-CVM) need to approve each new hemp ingredient (whether that be hempseed meal, hemp biomass, etc.) to be fed to each new animal. Hempseed is the target for many feed applications, though other plant parts also have potential in the animal feed market.

Until federal approval, states can only approve new food ingredients, such as hemp, for non-production animals (those that humans don’t consume).

That prospect may seem dismal at face value, but it could work harmoniously with industrial hemp’s evolution.

Feed Market Synopsis

It’s imperative to consider the breadth of the feed industry to understand hemp’s potential.

The bulk commercial feed market consists of large-scale feeders who formulate and mix rations in-house or buy bulk rations from third-party mills. Because of their scale, these feeders buy ingredients by the hopper load (50,000 pounds), and price is the key factor in determining purchases. Members of this market include cattle, pork, poultry, aquaculture, dairy, sheep and goat farmers, as well as custom formulators, all of whom have their unique demands and preferences. By volume, the bulk commercial feed market, including the third-party mills, is the largest sector of the feed industry, according to PanxChange, and will be the ultimate test for hemp’s viability in animal feed.

Retail production feed is another potential sector for hemp, ranging from smaller-scale animal feeders to the neighbor who occasionally sells farm-fresh eggs. In general, this industry operates similarly to the bulk market, except on a much smaller scale. Plus, any benefits beyond price are more marketable here; an example would be marketing hemp’s nutritional or anti-inflammatory qualities as a competitive advantage for show cattle feed. Ultimately, hemp will be relatively more successful here because of its nutritional benefits and marketability, but it should follow the same trend as bulk markets.

The next potential hemp feed market is pet and companion animal food, ranging from house pets to large animals such as horses. In this sector, price is still a significant factor for ingredient purchasing, but marketability is just as important—think premium versus generic dog foods. Hemp will gain traction through wellness marketing. And meat-based pet food ingredients are more expensive than plant-based ingredients, which may make hemp an easier inclusion for animal nutritionists due to its inexpensiveness relative to its nutritional profile.

Lastly, let’s consider the supplement market, which consists primarily of highly concentrated ingredients used to make up for micronutrient deficiencies. The supplement market spans across the entire animal feed industry, with many livestock farmers and pet and animal feed producers utilizing it to some degree. While more research and data on nutritional content are needed to determine hemp’s role in the supplement market, there is massive potential for hemp to be a cost-effective substitute for expensive supplements.

Projected Market Share

What would it look like if hempseed meal were fully approved for animal feed today? Would every feeder near a mill be waiting at the gate to stock up on hempseed meal or cake? It depends entirely on the price and, for larger scales, the guaranteed supply.

Any large-scale feeder balances their herd’s health and rate of gain with the cost of their rations, and any significant ration change has an impact on the herd’s performance. Therefore, a new feed ingredient must be priced low enough to recuperate an expected loss of performance. Also, there must be enough supply to keep the ingredient in the ration for an extended amount of time—roughly 120-180 days, based on my cattle-feeding experience.

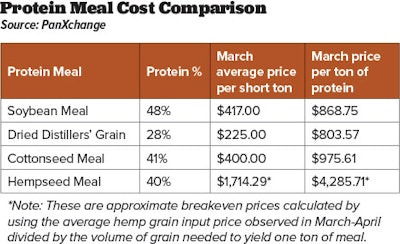

Soybean meal, dried distillers grains (DDG), and similar feedstocks will be hempseed meal’s largest competitors. The table above compares the protein content and average prices of these feeds.

It’s clear that hempseed meal has miles to go before competing at scale with major feed inputs as a principal protein source. Soybeans and corn, the main inputs for DDG, are primarily grown and developed to yield grain, with corn pushing the capacity to yield over 14,000 pounds of grain per acre. There would have to be significant economic and genetic developments for hemp to compete as a principal protein source.

Benefits of Hemp as Feed

However, hemp’s primary advantage is its versatility, which will provide several angles for the industry to expand its feed footprint.

The first possibility is that other segments of industrial hemp will grow, cheapening the overall breakeven prices of other byproducts. If fiber, hemp hurd, and/or other grain applications (e.g., food items for human consumption) develop large, profitable scales of operation, feed-grade hempseed meal will be treated as a byproduct, making sellers much more willing to accept competitive prices. But the scale of these other applications must develop dramatically for this to occur.

The second scenario highlights the versatility of hempseed. Protein may be the largest determining factor for feed meals, but ration formulations require nutrients beyond protein, including fatty acids. Many of these inputs are much more expensive than primary, or macro, feed ingredients. Hempseed meal, hempseed oil and other byproducts have an advantage when considering the entire profile of a ration, which could justify hemp inputs being included to provide fatty acids and other benefits without sacrificing protein. A great comparison would be fishmeal (around 65% protein), which, as I have seen in my experience at JBS, commands prices up to $1,500 per ton because of its nutritional content beyond protein.

Lastly, other possible hemp products that could be viable for feed must be considered. For example, spent (post-extraction) biomass material or lower-grade materials could be repurposed as roughage or silage—fibrous ingredients, like hay, that some livestock need in their diets. However, additional processing is likely needed to render these products into viable ingredients.

Overall, hemp will need a combination of all the above factors to realize its potential. Although hemp is not a competitive primary protein source for the broad feed industry in the near term, its ability to provide certain nutrients without sacrificing protein could garner long-term market share.

Projections for the Future

Once approved for animal feed, hemp’s potential as a feed ingredient will go beyond hempseed meal. Oil cannot be overlooked given its qualities, and spent material and other organic byproducts could be cheap sources of feedstock as well. Without massive developments in hemp genetics and the hemp marketplace, the success of hempseed meal will be capped short-term as a secondary ingredient. However, a supplemental role is all hemp needs, given current production outlooks.

Limited state approvals for hemp use in animal feed, like Montana’s, may be exactly what hemp needs to get the ball rolling, although federal approval could unlock the door to this market. In the longer term, the trend toward sustainability will increase hemp’s market share in the feed industry.