The interest in and popularity of delta-8 tetrahydrocannabinol (THC) snuck up on the cannabidiol (CBD) and cannabis industries—social media posts about delta-8 increased 550% from October 2020 to February 2021, according to Brightfield Group data.

Delta-8 is a variant of the well-known delta-9 THC cannabinoid. Though still psychoactive, delta-8 is reportedly less potent than delta-9. But unlike delta-9, delta-8 is being sold in CBD-friendly channels like vape shops and specialty retailers. This appeals to consumers in states without legal adult-use cannabis sales who are still looking for psychoactive effects, whether therapeutically or recreationally.

Hemp production is federally legal, which makes this cannabinoid easy to get in most places—especially online—and why many believe delta-8 is in the clear. Because it is mainly derived from hemp CBD, in many states, it’s technically in a legal gray area, which is sparking conversations about how to proceed with the intricacies. Now the questions of what happens next and whether bigger brands will jump on this bandwagon are up for debate.

“The competition CBD is feeling from delta-8 primarily impacts the cannabis and tobacco positioning for consumers who purchase through convenience stores and smoke or vape shops—these two channels together made up 7.3% of the CBD market in 2020,” Brightfield Group’s Managing Director Bethany Gomez explains. “As a result, some CBD brands are feeling a significant squeeze, while others that don’t compete in these channels are largely unaffected.”

Brightfield’s Q1 2021 CBD Consumer Insights survey asked CBD consumers if they were aware of delta-8 and whether they’d be likely to purchase it. Nearly one-fifth (19%) of CBD users are aware of delta-8, and 76% of those aware say they are “likely” or “very likely” to purchase it. Additionally, a recent vape and smoke shop survey from Brightfield showed some store owners reporting triple-digit growth as consumers become more aware of the cannabinoid.

Who is Purchasing Delta-8?

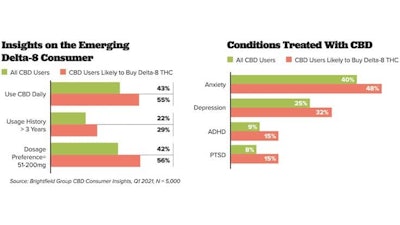

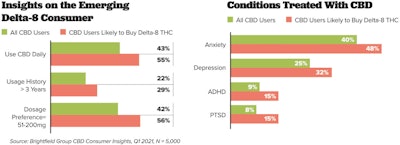

The consumers likely to purchase delta-8 have longer CBD usage histories, use more frequently, and prefer higher dosages, according to the survey. Being comfortable with CBD through experience, they are more open to trying products with delta-8.

Looking at purchase channels, those interested in delta-8 shop at smoke or vape stores and specialized CBD retailers more than the average CBD consumer. These channels were early to stock delta-8, so these consumers may have already been exposed to the cannabinoid.

CBD consumers interested in delta-8 are more likely to treat a mental health condition with CBD than the average consumer. Consumers actively treating mental health conditions with CBD may hope to find additional relief from delta-8. This especially applies to consumers who have used CBD with higher dosages for a long time. A high CBD tolerance may lead them to try a different cannabinoid if they haven’t done so already.

So, is delta-8 here to stay? Some states are pushing regulations on delta-8 to ensure compliance with existing state and federal laws and curb any safety concerns—Washington for example, recently banned synthetic delta-8 products. But overall, many states are still grappling with delta-9 THC regulations, and various channels are seeing delta-8 products fly off the shelves. The jury is still out on delta-8’s lasting availability.

Editor’s note: This article originally ran in the June issue of Hemp Grower’s sister publication Cannabis Business Times.