U.S. hemp cultivation exploded in 2019 after the federal government legalized it via the Agricultural Improvement Act of 2018 (the 2018 Farm Bill). According to Hemp Benchmarks’ most recent accounting, states licensed roughly 570,000 acres for outdoor cultivation in 2019, with almost 4,000 additional acres permitted for indoor and greenhouse growing. We estimate farmers planted approximately 250,000 to 260,000 acres for cannabidiol (CBD) production. We also estimate that farmers successfully harvested and dried fewer than 100,000 acres of high-CBD hemp biomass, making it viable for processing into various CBD products.

Even with only 15% to 20% of total licensed acreage ultimately producing usable hemp-derived CBD biomass, 2019’s hemp harvest swamped existing processing capacity, leaving many farmers sitting on unsold crops into 2020. Reports from both market participants and state regulators told of CBD extraction operations at capacity as recently as February 2020. Instead of purchasing biomass from farmers, many processors have been offering to extract CBD (or other cannabinoids) for tolling fees (set fees, often per pound) or splits (in most scenarios this means that the farmer will take part of the resulting extracted product as payment), leaving growers with various forms of extracted CBD that they then have to attempt to move.

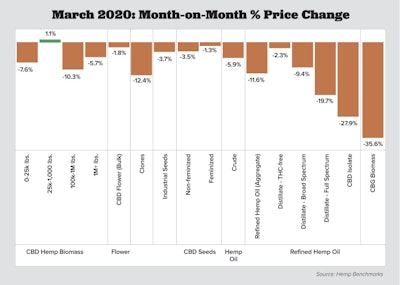

These market conditions resulted in high-CBD biomass prices tanking from early 2019 through early 2020. Hemp Benchmarks began assessing prices in April 2019; at the time, CBD biomass was going for $3.83 per percent CBD per pound. (For example, if a pound of biomass contained 4% CBD, its value would be $3.83 x 4 = $15.32/pound.)

By February 2020, the price had dropped by 74% to $1.01 per percent CBD per pound. Prices for various forms of extracted CBD have also seen steep declines during the same time period.

While significant consumer interest in CBD exists, demand has been difficult to quantify definitively. Additionally, CBD currently exists in a regulatory limbo. Although the 2018 Farm Bill removed CBD from the list of Schedule I drugs under the Controlled Substances Act, the U.S. Food and Drug Administration (FDA) has stated that CBD cannot be marketed as a dietary supplement nor added to foods due to its status as a drug ingredient. (The FDA has only approved CBD in the form of the prescription drug Epidiolex for the treatment of rare forms of epilepsy.)

This regulatory uncertainty has prevented traditional sales channels, such as national retail chains, pharmacies and grocery stores, from carrying many of the products manufactured and marketed today. While major national retailers have begun to carry CBD, they have predominantly focused on topical products so as to not run afoul of the FDA’s current stance. Many CBD companies are adding CBD to foods and beverages and selling them in the form of supplements, but such products, which do not comply with the FDA’s current stance, are being carried largely by small specialty retailers that do not have nearly the buying power of national pharmacy and grocery chains.

Hemp Benchmarks’ price assessments for refined hemp oil, a category of products that includes various forms of CBD distillates, showed a 66% price drop from April 2019 to February 2020. Prices for CBD isolate have declined by 74% in the same period, while crude CBD oil prices have plummeted by 87%. The tough financial situations facing some major CBD processors have resulted in market participants worrying that prices will deteriorate further as inventories are liquidated in bankruptcies or prices are slashed to move product and generate much-needed cash flow.

Looking Ahead in 2020

Considering the current market landscape, here are four opportunities and challenges in and around the U.S. hemp industry in 2020 and beyond.

1. Processing capacity of all kinds must be increased to accommodate domestic production. Despite rapidly eroding CBD biomass prices, early signs indicate that all types of hemp production will expand in 2020. Poor weather impacted 2019’s crop at key points in the growing season, raising the possibility that better conditions could result in a significantly larger harvest this year. CBD processing facilities are at capacity, and even less capacity may be available as some operators scale back or go under. More cannabinoid extraction processing capacity is necessary to accommodate production. Also, the development of decortication facilities, which are currently scarce, and other types of non-cannabinoid hemp processing would provide growers with more options to plant and sell crops for fiber or other purposes.

2. Harvesting, drying and storage processes and options for hemp biomass have significant room for improvement. In 2019, farmers faced significant challenges harvesting, drying and storing their crops properly to keep them saleable to processors. Significant crop loss occurred during and after harvest; many growers cut down plants by hand, hung hemp in barns and used hand-built band dryers, resulting in improperly stored biomass lost to mold. With a generally oversupplied market, standardized processes and options tailored specifically to hemp biomass drying and storage to preserve cannabinoid concentrations and prevent mold would be a major help to hemp growers.

3. Regulatory certainty on CBD and other cannabinoids is necessary for industry expansion. The FDA’s current stance on CBD is effectively suppressing demand for products by keeping major wholesale buyers on the sidelines. While the FDA has noted that developing regulations for CBD for use as a dietary supplement or food ingredient could take years, state and national lawmakers, as well as industry groups, have been pushing for the formulation of such policy sooner. If the FDA allowed CBD to be marketed as a supplement and added to foods and beverages in 2020, that would almost certainly help move the current inventory buildup of CBD oils.

4. Smokable CBD flower and other cannabinoids provide opportunities for growers to command higher prices but come with major uncertainty. In 2019, hemp growers who sold high-CBD smokable flower saw significantly higher prices for their product compared to CBD biomass. Additionally, cannabigerol (CBG) biomass has typically garnered rates in excess of 10 times those of CBD biomass in recent months. However, prices for both smokable CBD flower and CBG biomass have been on the decline as well. Major questions remain about the scope of demand for each, and some states are outlawing smokable hemp.

In a dynamic new industry, hemp businesses should do their best to carefully plan 2020 operations using current available data. While Hemp Benchmarks’ price assessments have shown significant downturns in the prices for many products in this young supply chain, increased price transparency can enable farmers, processors and others to make more informed decisions and optimize operations for maximum benefit.