As hemp-derived cannabidiol (CBD) products continue popping up on shelves in stores across the country, we are just beginning to understand who these consumers really are. In September 2019, CBD and cannabis research firm Brightfield Group conducted a survey with 5,300 respondents to analyze their demographics, preferences, usage patterns and more in the booming CBD product industry.

Sales of CBD products reached $4.1 billion in 2019, a 562% increase from sales of $627 million in 2018, according to Brightfield Group’s research. Hemp-derived CBD became legitimatized and surged in popularity among Americans following the passage of the Agricultural Improvement Act of 2018 (the 2018 Farm Bill), which legalized the cultivation and sale of industrial hemp and removed it from the list of Schedule I Controlled Substances.

Brightfield Group has found that a movement away from Big Pharma and toward more natural health and wellness trends is bolstering CBD’s popularity. Along with those trends, more mainstream retail channels offering CBD products has also fueled the cannabinoid’s popularity.

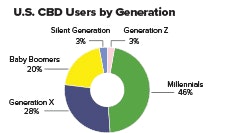

Generational Trends

With CBD believed to have multiple benefits for ailments such as anxiety, chronic pain and insomnia, as well as a wide array of product formats, CBD can appeal to every generation.

Nearly half of CBD consumers in the U.S. are millennials, between the ages of 23 and 39, according to Brightfield Group’s consumer insights. The uptick in CBD use among millennials comes as self-care routines continue gaining momentum across the U.S. Among all generations, self-care is garnering attention for its focus on taking care of one’s mental, emotional and physical health as consumers seek new ways to manage daily stressors, rising anxiety levels and ever-increasing busyness. CBD is just one of many items in the self-care toolbox in addition to practices like meditation and yoga.

Millennials are turning to CBD as a natural alternative to treat a variety of ailments. Among millennial CBD consumers, 56% stated they were using CBD to manage anxiety, followed by depression (33%) and insomnia (18%). Many millennials also consume CBD regularly, with 48% indicating they use it two or more times a week. Oil cartridges/vaping, gummies/candies and skin care/beauty products are the favorite CBD formats among millennials. Vapes offer fast-acting relief, while gummies offer a tasty and easy way to consume CBD. The latter have begun to position themselves as a product akin to gummy vitamins.

Generation X is also embracing CBD: 28% of all CBD consumers reported they are between the ages of 40 and 54. The top three medical conditions they turn to CBD for are anxiety, inflammation and depression. Many Gen Xers are dealing with high levels of stress, especially as they balance caring for both their children and their elderly parents.

Gen Xers are looking for tangible results; desired effect is the most important attribute to them when choosing a CBD product, followed by price and the quality of ingredients. Oil cartridges/vaping, gummies/candies, tinctures (also called CBD oils) and topicals are the most popular CBD formats among Gen X consumers. A sizable portion of the generation also tends to consume CBD frequently—31% of Gen Xers report using CBD five or more times per week.

Meanwhile, more baby boomers are consuming CBD as they learn about its benefits. In 2019, 20% of CBD consumers were aged 55 to 73, up from 17% in 2018. Baby boomers report they are learning about CBD through friends and family (43%), their doctors (17%), the news (16%) and through their own research of medical conditions (7%). Baby boomers cite age-related inflammation, chronic pain and anxiety as their top three medical reasons for consuming CBD. This generation tends to consume CBD even more frequently than Gen Xers, with 34% indicating use five or more times per week.

For baby boomers, tinctures and topicals are the favored CBD formats. Tinctures are frequently used as part of a daily routine for anxiety relief and to aid with sleep. Topicals, such as balms and roll-ons, are popular for those experiencing either chronic pain or sore muscles and joints. The expanded availability of CBD topicals in drugstore chains like CVS, Walgreens and Rite Aid as well as in independent pharmacies is familiarizing more boomers with CBD.

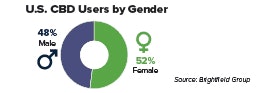

Women vs. Men

While both men and women are consuming CBD, many CBD companies specifically target women—a population whose role has traditionally included safeguarding the family’s health. Women use CBD slightly more than men: 52% of CBD consumers are female, according to Brightfield Group. CBD products popular with women include oil cartridges/vaping, topicals and tinctures. In contrast, the top three CBD products men consume are oil cartridges/vaping, gummies/candies and tinctures.

Skin care and beauty products are also favored by women, especially those who are brand-driven and more likely to spend more per product, also known as “Glam Users.” CBD companies and retailers are courting Glam Users with expanded CBD beauty and skincare product lines at beauty specialist retailers Sephora and Ulta Beauty, along with department stores like Neiman Marcus, Nordstrom and Dillard’s.

Other Trends

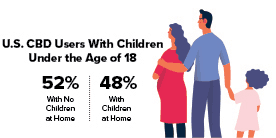

As CBD becomes a mainstream addition to products, it is being used by consumers of all ages, including parents of young children. Almost half (48%) of CBD consumers have children under the age of 18 living at home. Among female CBD consumers, 50% of them stated they have children younger than 18. In the Gen X group, 54% of female CBD users have children under 18 who live in the household. Efficacious, fairly priced CBD products with a simple ingredient label are likely to appeal to these busy mothers.

CBD consumers generally have higher levels of education. Over 73% have an associate degree or higher, while 33% have a bachelor’s degree or higher. Overall, CBD consumers are middle-class, with 59% having an annual household income of at least $40,000. Among higher-income consumers with an annual household income of $100,000 or more, 61% spend $51 or more per CBD product, while 52% of total CBD consumers spend that amount.

With new CBD brands coming onto the market every week, it will be crucial for everyone in the CBD supply chain to understand these consumers. Greater knowledge about the CBD customer can help hemp cultivators begin implementing brand-building techniques that cater to these consumers. When the products are ready to hit shelves, targeted marketing efforts can not only help products stand out, but also help gain brand recognition and loyalty. Above all, being aware of end consumers can help tailor every step of the process to meet them where they are with products they want—and need.