For many farmers, the 2020 hemp season added heartache to an already grim pandemic year. Excess biomass from 2019 left deteriorating in storage drove wholesale prices to new lows. But the year’s end yielded a bright spot in one market segment: smokable hemp flower.

This segment is not without its challenges, as noted in an article in the January issue of Hemp Grower. Some states have banned it, while others have embraced it or looked the other way. But for hemp farmers and consumers, craft hemp flower and smokable hemp popularity keeps growing.

From Bans to Benefits

As general counsel for the U.S. Hemp Roundtable, a nonprofit coalition of hemp industry advocates, Jonathan Miller understands the smokable hemp debate. He finds farm groups are particularly supportive of smokable flower. “When it comes to the selling of flower, it is the easiest … way to the marketplace—and it’s also quite a profitable opportunity,” he says. However, Miller says that some members of the hemp industry have concerns regarding potential health risks inhalable products may present.

In addition, much opposition to smokable hemp flower rides on law enforcement’s inability to easily distinguish federally legal hemp flower with low tetrahydrocannabinol (THC) content from higher-THC cannabis. Miller hopes technological advances soon remedy that problem—for law enforcement and for consumers.

“But, for the time being, there is—particularly among some law enforcement—a real hostility toward selling hemp flower because of the fear that it’s just an end run around the marijuana laws,” he explains.

With U.S. Hemp Roundtable membership divided on how smokable hemp should be regulated, Miller says the organization is staying neutral for now. “It creates a real challenge when you have each state doing its own thing,” he says. “We’re hopeful that, like on some of the issues we’ve talked about with hemp and CBD, the FDA finally comes in and recognizes and regulates these products.”

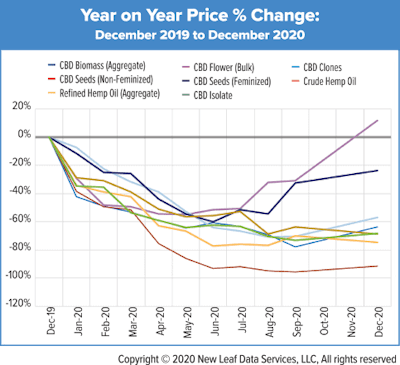

Adam Koh, editorial director for industry data and intelligence firm Hemp Benchmarks, underscores the smokable segment’s attraction to farmers. As 2020 prices for most hemp products fell, finally leveling off late in the year, bulk flower was an exception. “Smokable hemp is one [segment] where we’ve seen it have the most significant price increase of any of the hemp product categories that we track,” Koh shares.

Hemp Benchmarks reports wholesale bulk flower prices were down more than 50% from December 2019 to May 2020. But bulk flower value slowly began to rise and finally passed back into a positive price difference in November 2020 from the previous year—the only major category to do so. Month-over-month pricing increased 32% from November to December 2020, when bulk flower was selling at around $250 per pound.

Hemp consumers have learned (and research shows) that inhalable products offer the fastest delivery of medicinal and therapeutic benefits of cannabinoids. As the hemp market matures, it appears consumers are willing to pay more for high-quality craft hemp flower. And farmers are responding.

“We are seeing more indoor-grown and greenhouse-grown smokable hemp coming to market as the popularity and demand for the product has cemented itself last year,” Koh says. “It seems like some growers are running their operations somewhat similarly to those who grow THC cannabis—cultivating it indoors so that the flower can be grown in more controlled cultivation conditions.”

Koh adds that some smokable hemp that meets U.S. Department of Agriculture (USDA) standards for organic certification is commanding premium prices relative to Hemp Benchmarks’ assessed averages. International pricing for hemp flower is rising as well.

Caught at the Crossroads

As the smokable hemp debate moves forward, state bans have left some flower farmers in limbo. In Texas, a state ban prohibits the manufacture, processing, distribution and retail sale of hemp for smoking. But a subsequent legal challenge and temporary restraining order prevent the ban from being enforced until the lawsuit is resolved. (As of press time, the next hearing for the case, Crown Distributing LLC et al. v. Texas Department of State Health Services et al., was set for March 22.)

Texas grower Taylor Kirk is founder of 4K Pharm LLC, a self-described family-owned craft cannabis farm operating as a licensed hemp producer, manufacturer and distributor in the state. Before starting the farm, Kirk was director of cultivation and vice president of operations for one of Texas’ three medical marijuana licensees.

Kirk and his wife and business partner, Megan, received their hemp production license in May 2020, and they focus their energy on producing premium craft hemp flower.

An indoor propagation and vegetation area complements the farm’s 2,400-square-foot, custom-built light deprivation greenhouse. But the uncertainty introduced by the Texas smokable hemp ban has kept the couple from moving forward with some aspects of their business plans.

“I don’t want to be viewed in a negative light in the industry here,” Kirk explains. “My goal is premium flower production. I am a cannabinoid hemp producer, but I’ve held off of investing in the equipment necessary to manufacture smokable hemp, which would be basically pre-rolls and cigarettes, and I’m waiting for the court case to be settled.”

With an unenforced ban in place, Kirk says smokable hemp is still being marketed and sold everywhere. Retailers he’s spoken with estimate that 50% to 60% of their hemp shop sales come from smokable hemp—much of which they’re buying from other states because of the ban.

For Kirk, who reiterates his intention to “operate with complete transparency and within the legal boundaries,” the ban puts him and his raw, dried-and-cured hemp flower in a difficult spot—one that has him examining his options for moving forward, depending on the final ruling on Texas’ smokable hemp ban.

He says there’s no question that flower—especially premium craft flower—represents a farmer’s most lucrative avenue. Over the past year, he saw regional wholesale pricing for hemp flower range from $300 to $1,500 per pound, depending on quality and cannabinoid content. His greenhouse-grown flower typically brought $500 to $1,000 per pound. “Retailers are selling product for roughly double the wholesale cost,” he says.

Kirk believes conscientiously crafted hemp flower can also overcome negative consumer perceptions caused by misleading and mislabeled CBD products. “When you look at smokable hemp, you can’t ignore the quality of the flower and a test result that shows you the percentages of cannabinoids and the safety aspects of microbial contamination or heavy metal contamination or pesticide contamination,” he says. “They know exactly what they’re getting in their flower.”

Driven by Medicinal Benefits

Maryland’s hemp laws don’t treat hemp flower nor smokable hemp differently than other forms of the crop. Though the laws don’t threaten hemp flower production, industry uncertainties are still in play. For Tyler Van Wingerden, vice president of family-owned and -operated Catoctin Hemp, enthusiasm for the health benefits of hemp-derived cannabinoids has the farm hanging in for a third year. Van Wingerden is putting energy into smokable flower as part of a larger plan.

Catoctin Hemp shares the property with Catoctin Mountain Growers, the family’s 35-year-old ornamental plant business that has 600,000 square feet of greenhouse space. In the company’s first year of growing hemp, Van Wingerden put Catoctin’s expertise to use growing hemp starts, which are also referred to as “liners” in the greenhouse industry and “clones” in hemp. The company expanded into extraction when farmers who bought their starts experienced a bottleneck in extraction. All in all, that first season went well.

But 2019’s biomass glut and low prices led fewer farmers to plant hemp starts in 2020. Some cut back production; others went with cheaper seed instead. With a sudden excess of unsold hemp starts, Van Wingerden saw an opportunity in smokable hemp flower. He planted 1 greenhouse acre with approximately 12,000 plants last year.

“There was a big learning curve” at first, he shares. Relatives in the medical cannabis industry provided helpful advice, but Van Wingerden says, “you still always have to learn a lot yourself.”

The operation received positive feedback for the crop’s color, taste and smell, but not for its bud size, he says. Van Wingerden attributes that, in part, to the company’s first run at drying and curing flower, which left buds way too dry, he says. And when growers are paid by weight, overly dry buds mean lost revenue.

This year, he’s trying four new hemp varieties along with refined post-harvest handling. “We’re going to go on for another turn of some smokable here, along with some other varieties that we’re trying,” he says. He plans to devote about 50,000 square feet (just more than an acre) of greenhouse space to hemp flower for 2021.

Over the past two years, Van Wingerden has gone from a skeptic to a believer in the medicinal benefits of cannabinoids. That belief is keeping Catoctin in the game. “We are super excited about that aspect of the plant ...,” he says. “If that wasn’t the case, we would not be with it anymore.”

Cultivation Comparisons

Both Kirk and Van Wingerden say growing premium hemp flower is a much more labor-intensive process than growing hemp for extraction or other purposes. “That’s a whole other beast to learn just how you handle it post-harvest, and [it’s] very different than how you handle hemp biomass,” Van Wingerden says. “And it’s obviously very different than how you handle a petunia.”

For any grower expecting to add hemp for an extra turn in the greenhouse (like they might do with a crop of fall pansies), Van Wingerden urges caution. He describes a hard line between growing hemp and handling it after growing, but he says even growing hemp isn’t simple.

He compares the rooting process to a poinsettia, a notoriously fussy greenhouse crop. “We rooted half a million hemp cuttings in 2020,” he says. “These are very similar to the poinsettia plant in the attention and care they need in rooting.”

Kirk considers hemp a little more forgiving than high-THC medical cannabis, but he believes growing for higher cannabinoid content in either market leaves plants more finicky. That’s another reason that controlled environments such as indoor and greenhouse grows yield higher-quality crops. But that too comes at a cost.

Craft hemp flower producers invest time, labor and inputs comparable to premium recreational cannabis or medical cannabis growers, but margins don’t stack up.

Hemp Benchmarks puts it in perspective: While wholesale pricing for bulk CBD hemp flower was around $250 per pound in December 2020, a pound of outdoor-grown flower in the cannabis market brought $900 per pound. Greenhouse-grown cannabis hit $1,400 per pound.

“From the last round, we know we need to raise our prices a little bit. It is a very expensive and tedious thing to produce a high-quality bud for smoking,” Van Wingerden says. “In our ... region, [medical cannabis] is fetching about 10 times more per pound than what we’re having people try to pay for the hemp.”

He acknowledges that bureaucracy, regulations and restrictions faced by medical cannabis growers warrant a higher price, but not tenfold: “... From a growing, curing and processing standpoint—it’s almost identical,” Van Wingerden says.

But while biomass remains a tough sell right now, and despite price disparity with medical cannabis, he believes business models with hemp flower can be profitable.

Flowery Futures

Miller expects the demand for smokable hemp flower and other inhalable hemp products will increase. But industry obstacles to the segment’s growth must be resolved.

“To me, the most important thing we can do as an industry is really promote the development of technology that helps distinguish between hemp and marijuana—kind of roadside THC testing,” Miller says. “If that comes into wide use, it will eliminate most of the challenges that we see from law enforcement.”

Koh advises growers lured by flower’s price relative to biomass to research the added time and labor the crop requires. “For those growers that are looking at it and seeing the price difference and thinking maybe they can make up their margins that way, it’s important to be aware that it does come with extra costs to bring a really solid product to market."

Van Wingerden likewise advises greenhouse growers or hemp farmers considering smokable hemp to do their homework. “Don’t just take numbers from articles online. Go talk to people who are doing it. Get an idea of what’s going on and kind of see the process happening,” he suggests. He thinks seeing what it takes to harvest and process hemp for smoking might change some minds.

“It’s a lot of people. It’s a lot of work. ... Just get an idea before you jump into it because there’s a lot involved,” he says. “The growing process is almost easier than the curing and drying process. ... And you’ve got to do it right.”

But, Van Wingerden adds, if growers focus their attention and don’t take post-harvest work lightly, they can reap some rewards. “If you have a nice bud, and it looks good, smells good and has good size, you should be able to get paid for that,” he says. And for many hemp farmers, that sounds like a good incentive to start.