Last year, significant demand for smokable cannabidiol (CBD) hemp flower emerged in the U.S., prompting many hemp growers to devote portions of their production to meet that demand. While costs to generate dried, trimmed hemp flower for smoking are higher than those to produce CBD hemp biomass for extraction, Hemp Benchmarks’ latest data from July shows that a pound of smokable CBD hemp flower was selling for almost 20 times the price of biomass for extraction, assuming a CBD potency of 10% for the latter.

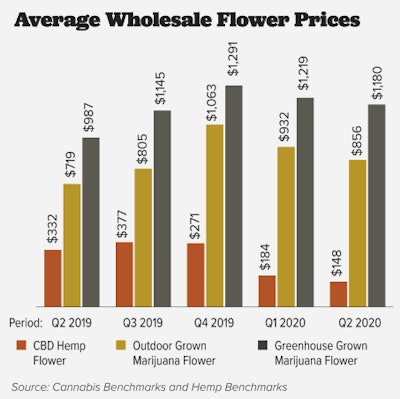

However, wholesale prices for smokable CBD hemp flower are still significantly lower than those for outdoor and greenhouse-grown cannabis flower with high tetrahydrocannabinol (THC) content. (See the chart below.) (Editor’s note: Indoor CBD-rich flower was not included in the comparison since hemp is typically not grown indoors.) This is despite the fact that smokable CBD hemp flower and THC-rich cannabis flower are essentially the same in terms of cultivation and processing; only the dominant cannabinoids differ.

Several factors account for the prices of THC-rich cannabis flower being so much higher than those of CBD hemp flower:

- Legal cannabis businesses are subject to significantly higher regulatory burdens, including security requirements, seed-to-sale tracking, waste disposal mandates, and pricier licensing fees (which can cost five or six figures annually in some states). Producers pass these costs on in product pricing.

- Consumers have been employing THC for various purposes for centuries, while CBD only came to prominence less than 10 years ago. In other words, demand for THC cannabis flower is much more established. Additionally, legal cannabis markets have expanded the consumer base for their products due to both the COVID-19 pandemic and a growing number of customers switching from the illicit market, as demonstrated by recent record-breaking sales figures out of numerous states.

- As it is still a federally illegal Schedule I controlled substance, supply of THC cannabis flower in legal markets is often limited by license caps and limits on production per individual businesses. States have striven, with various levels of success, to avoid significant overproduction so as not to antagonize the federal government with excess supplies of THC products in the marketplace. Hemp, on the other hand, is legal federally; the Agriculture Improvement Act of 2018 (the 2018 Farm Bill) legalized hemp cultivation (with certain restrictions and requirements) and removed CBD from the Drug Enforcement Agency’s list of controlled substances. As a result, it can be produced in every state where a hemp production program has been established, which includes almost the entire U.S.

Hemp Flower’s Future

So, what does the future hold for CBD hemp flower? Can any lessons from the legal cannabis industry offer insight into future pricing trends?

In the current regulatory environment, the future is hazy. Significant regulatory and legal questions must be resolved before the market for smokable CBD hemp flower can mature and stabilize. These include a determination from the U.S. Food and Drug Administration (FDA) on how CBD will be regulated, as well as bans on smokable hemp flower being implemented in several states, some of which have come under legal challenge.

There is also the question of how much demand for smokable CBD hemp flower actually exists. The market size has not yet been able to be quantified with any degree of certainty, making future projections essentially meaningless.

Still, some reasonable assumptions can be drawn from the legal cannabis industry regarding the future of wholesale pricing for smokable CBD hemp (assuming it remains legal and demand persists).

One assumption is that price volatility will lessen over time. The legal hemp industry is still in its infancy. Overweening enthusiasm on the production side resulted in dramatic wholesale price erosion over the course of the past 16 months in which Hemp Benchmarks has been assessing prices. Legal cannabis markets in several states—including California, Colorado, and Oregon—experienced the same in their early years but have been characterized by greater wholesale price stability as they mature.

If regulatory issues are resolved favorably and demand can be expanded, prices for smokable CBD hemp flower could conceivably rise in the coming years. The current, relatively high prices for THC cannabis flower are the result of such a recovery as legal cannabis markets grew demand and some producers who were early entrants exited (either due to bankruptcy or acquisitions), allowing remaining cultivators to better gauge and balance supply and demand.

Even in a favorable future, however, it is highly unlikely that smokable CBD hemp flower prices will catch up with THC cannabis flower prices. In general, wholesale prices tend to move toward the marginal cost of production in mature commodity markets. This can be relatively low for hemp and will almost certainly fall as cultivation methods become more efficient and breeders develop better cultivars, among other potential advances. Prices for THC cannabis flower, however, have taken a different course in the federally illegal market and remain elevated artificially as production and interstate commerce are restricted due to continuing prohibition.