LEDs LEAD DIVERSE LIGHTING CHOICES

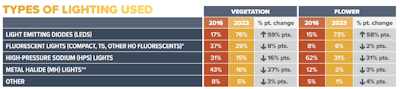

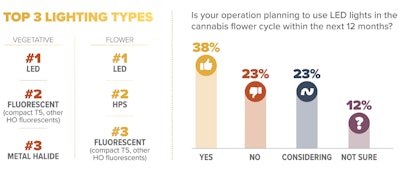

Last year, for the first time in this report’s history, more than 70% of research participants from commercial indoor and greenhouse cultivation operations with supplemental lighting reported using “light-emitting diodes” (LEDs) in every growth stage. That represented a 55-percentage-point jump, on average, from 2016. While LEDs continue to dominate lighting choices for commercial cultivators for veg and flowering in 2023, study results show some growers seek other solutions.

Vegetation: 76% of 2023 research participants reported using “light-emitting diodes” (LEDs) for vegetation, up 59 percentage points since 2016. Nearly a third (29%) of participants reported using “fluorescent lights (compact, T5, other HO fluorescents),” but use of the technology has declined among participants by 8 percentage points when compared to 2016. At 15%, the number of participants using “high-pressure sodium (HPS) lights” decreased 16 percentage points from 2016.

In 2016, “metal halide (MH) lights” took the top spot for veg lighting, used by 43% of growers that year. For 2023, only 16% of commercial grower participants used metal halides for the vegetative stage—27 percentage points less than 2016.

Flowering: The vast majority (73%) of 2023 study participants indicated they use LEDs in flower, up 2 percentage points from last year and 58 percentage points since 2016.

Nearly a third (31%) of commercial grower participants reported using HPS lights this year—reflecting about a 50% decline since the first year this study was conducted (2016), when 62% of research participants cultivating commercial grows indoors or in greenhouses, with or without supplemental lighting, reported using HPS lights in flower.

Future plans signal more shifts for those cultivators not using LED lighting or using no supplemental lighting: 38% of those participants indicate their operation plans to use LEDs in the cannabis flower cycle within the coming year, and another 23% are considering using LEDs.

FACTORS DRIVING LIGHTING DECISIONS

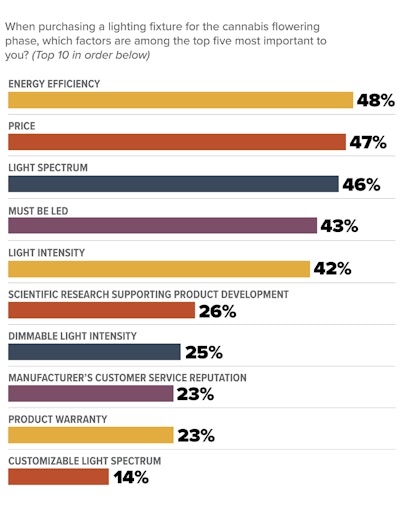

In last year’s study, “light intensity” led the list of the top five factors influencing lighting fixture purchases for flowering. But this year’s research saw a shift. “Energy efficiency,” cited by 48% of research participants in 2023 and 2022, was the most-cited, top-five purchasing factor among study participants growing commercially in an indoor facility or greenhouse in this year’s research.

“Price” was a top-five factor for 47% of 2023 participants, down 5 percentage points from last year. Next up was “light spectrum” for 46% of 2023 participants, followed by “must be LED” at 43%. “Light intensity” finished out the top-five most important purchasing factors for flowering at 42% of 2023 participants, down 11 percentage points from 2022.

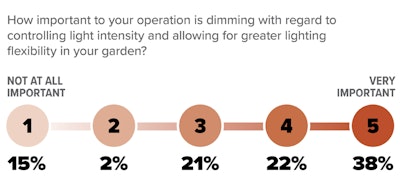

On a related note, interest in dimmable light intensity diminished among this year’s study participants. When asked about the importance of dimming as it relates to controlling light intensity and enhancing lighting flexibility, 38% of commercial growers cultivating indoors or in greenhouses said dimming was “very important,” down from 47% of participants last year. Fifteen percent of 2023 participants reported dimming was “not at all important,” compared to 8% in 2022.

When asked more broadly, “What are the top three considerations, ranked in order of importance to you, for current or future LED use in your cannabis cultivation operation for 2024?” the top-selected answers differed slightly, with 62% of participants ranking “crop quality” as their top choice, followed by “yield” (16%) and “energy efficiency” (12%).

LIGHTING CHALLENGES + LED ANSWERS

In many ways, cannabis cultivation has grown easier thanks to advanced growing technologies, including lighting. But economic and legislative landscapes continue complicating the path to profitability. The top lighting challenges reported by commercial cultivators in this year’s research reflect those hurdles.

For the third year running, “managing energy costs” was named the single greatest lighting-related challenge among commercial cultivation operators using supplemental lighting in an indoor facility or greenhouse—cited by 21% of participants, compared to 22% last year.

Seventeen percent named “ensuring consistent/even lighting across the crops” as their greatest lighting challenge. “Lighting’s impact on plant growth (yield, internodal spacing, etc.)” (16%) and “managing heat load” (12%) rounded out 2023’s top four.

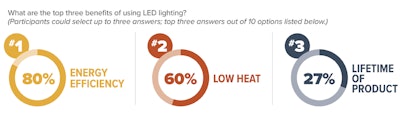

Among commercial cultivation operations growing indoors or in greenhouses, perceived benefits of LED lighting promise solutions. Four out of five research participants (80%) named “energy efficiency” as a top-three benefit of LED lighting. Three out of five (60%) cited “low heat” as a leading LED benefit. “Lifetime of product” took third place at 27%, a 12-percentage-point increase compared to 2022.

REBATE ACQUISITION & AWARENESS

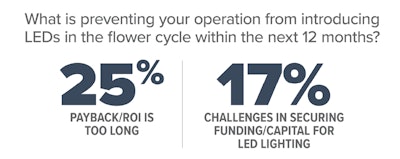

Cost is often cited as a barrier to LED adoption. Research participants who don’t plan to use LEDs in flowering in the next year named “payback/ROI too long” and “challenges in securing funding/capital for LED lighting” as top reasons preventing them from leveraging this technology. For many LED users, utility rebates and incentives provided crucial boosts, but rebate awareness remains low.

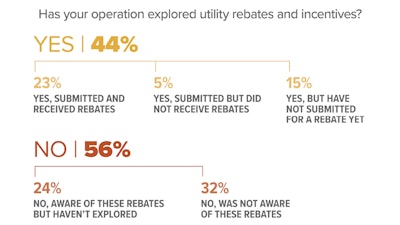

For 2023, 44% of commercial indoor and/or greenhouse research participants reported they “explored utility rebate incentives to subsidize the cost of LED solutions.” Nearly one-fourth (23%) have “submitted and received rebates,” compared to 18% in 2022. Another 5% “submitted but did not receive rebates,” while 15% explored options, “but have not submitted for a rebate yet.”

However, 56% of 2023 participants haven’t explored rebates at all, showing little change from 2022. Of those, about one-fourth (24%) said they are “aware of these rebates but haven’t explored,” and nearly one-third (32%) were “not aware of these rebates.”

Average Yields and Lighting Types

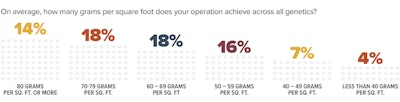

For many commercial cultivators in the cannabis industry, interest in spectra, light intensities and lighting technologies often boils down to yields. As demonstrated by this 2023 research, when examining average yields per square foot of flower canopy across all genetics, progress was clear.

Last year, more than half (55%) of research participants operating commercial indoor or greenhouse grows reported average yields exceeding 50 grams per square foot of canopy. For 2023, two-thirds (66%) of commercial growers fell within that 50-plus gram range.

This year’s research also offered a new category within that upper echelon: “80 grams per square foot or more.” Fourteen percent of commercial operations reported average yields in that top range in 2023. According to participants, not all operations track this metric, as 12% said their company “doesn't measure” this. Another 8% reported “operation measures but I don’t know.”

As growers pursue optimal yields, interest in augmenting overhead lighting grew slightly. Among study participants growing cannabis commercially in an indoor facility or greenhouse with supplemental lighting or those without lighting but considering greenhouse lighting within the next 12 months, more than 34% reported interest in exploring “side lighting,” compared to 30% last year. Interest in “intercanopy” and “sub canopy” lighting held relatively steady at 22% and 21%, respectively.

CANOPIES, FACILITIES & TIERS

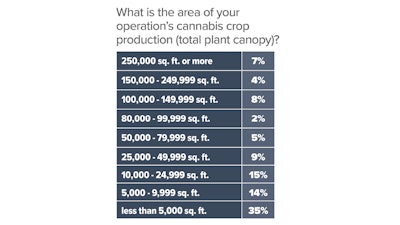

Last year, this report acknowledged that averages can mislead when data contains extremes—case in point, commercial canopy footage. Instead of the average canopy size, the 2022 report shared the median value for total plant canopy among commercial participants: 10,000 square feet. This year’s report again offers the middle value of all reported canopy sizes, where half of participants fall above and half below. Once again, median total plant canopy was 10,000 square feet for 2023. But filter out the 40% of commercial growers who also operate hobby or personal-use grows, and the commercial median total plant canopy increases to 19,370 square feet, compared to 14,770 square feet last year. For 2023, 26% of commercial growers operating indoor or greenhouse facilities cultivate 50,000 square feet or more of plant canopy. Sixteen percent operate a plant canopy of less than 1,000 square feet.

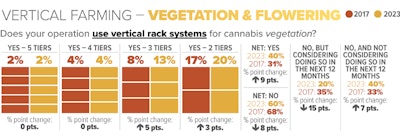

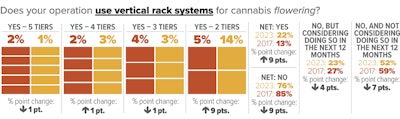

Forty percent of 2023 research participants who grow commercially in an indoor facility or greenhouse with supplemental lighting use vertical racks for vegetation, up 9 percentage points from the first time this report asked that question in 2017. Of those using vertical racks for veg, 50% use two tiers. Less than one-fourth (22%) of commercial cultivators growing under supplemental lighting report using vertical racks for flowering—9 percentage points higher than 2017. Of those using vertical racks for flowering, 65% stick to two tiers. This year’s study again confirmed many commercial cultivators operate multiple facility types. More than three-fourths of commercial growers (76%) grow indoors, down from 88% last year. Meanwhile, 39% of commercial participants cultivate greenhouse grows with supplemental lighting, up from 28% in 2022.