Editor’s Note: This article originally ran April 20 and has been updated to include recent movement in Congress.

Passing the U.S. House of Representatives for its fifth time, the Secure and Fair Enforcement (SAFE) Banking Act’s bipartisan backing was strong enough to move forward on a simple voice vote Sept. 21.

Previously, the legislation passed as a standalone bill with a 321-101 vote on April 19, but it has yet to make progress on the Senate floor.

Earlier this week, House lawmakers continued their effort to put pressure on the upper chamber to act by attaching an identical version of the standalone SAFE Banking legislation as an amendment to the National Defense Authorization Act (NDAA).

With a history of overwhelming and repeated support, SAFE Banking’s approval to be included in the defense spending package was not challenged for an official roll call vote by a single member of the House following voice passage in Tuesday’s amendment session.

RELATED: U.S. House Adds SAFE Banking to Defense Spending Package

Sponsored by Rep. Ed Perlmutter, D-Colo., the act aims to protect institutions administering financial services to state-legal cannabis, hemp and ancillary businesses.

When the legislation was previously debated as a standalone bill in April, Rep. Andy Barr, R-Ky., said it would provide clear direction for depository institutions to service legitimate businesses.

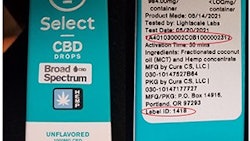

“This bill will provide additional clarity for banks, insurance companies and card processors that they can in fact do business with legally operating hemp businesses,” he said. “It would also direct our federal financial regulators to update best practices for serving hemp and CBD businesses.”

RELATED: How the Hemp Industry is Overcoming Banking Issues

Despite hemp’s legality on a national level, many industry business owners are still having trouble finding financial institutions that will work with them—especially when it comes to cannabidiol (CBD) businesses. To that end, many industry organizations are supportive of the bill.

But the bill contains a small provision that is concerning to others.

Larry Farnsworth, spokesperson for advocacy agency National Industrial Hemp Council (NIHC), said in April that the SAFE Banking Act defines “hemp-related legitimate businesses” as companies that engage in hemp or CBD business “in conformity with the Agricultural [sic] Improvement Act of 2018.”

Those cycling through material grown as part of hemp pilot programs under the Agricultural Act of 2014 (the 2014 Farm Bill) may not be afforded the same protections as those in states with new plans approved by the U.S. Department of Agriculture (USDA). Under the USDA’s final rule, states will be permitted to operate under their pilot programs until Jan. 1, 2022.

RELATED: 2020 Cultivation Data

Many farmers still have product left over from previous years that was produced under pilot programs, Farnsworth said. With the current language of the SAFE Banking Act, banks may be hesitant to service any business dealing with that leftover product.

“Ironically, we’re delegitimizing hemp as a business while we’re allowing the … marijuana industry to access the banking system,” Farnsworth said.

The Good News

Earlier this year, Farnsworth said the NIHC was working with Congress to amend the bill to include all legally operating hemp businesses, whether working within 2014 or 2018 farm bill framework.

“We would like to see a hemp economy that works for everybody,” Farnsworth said.

Aside from that provision, the NIHC and other industry groups are largely supportive of the SAFE Banking Act.

The bill has gone through several iterations over a span of a few years. According to U.S. Hemp Roundtable, language revolving around hemp and CBD businesses was added to the mainly cannabis-driven bill in late 2019. Importantly, the bill also clarifies that hemp businesses are not subject to the same scrutiny needed for adult-use cannabis.

The House has passed the SAFE Banking Act four times since 2019, but, so far, it has yet to reach the Senate floor.

“Prospects for the bill appear brighter this year with the change in control of the Senate,” U.S. Hemp Roundtable wrote on its website. “And the bill itself is much improved to explicitly protect financial and credit card transactions for hemp farmers and processors, as well as businesses engaged in the handling, manufacturing and sale of hemp-derived cannabinoid products such as CBD.”