[PRESS RELEASE] – TORONTO, March 6, 2025 – TerrAscend Corp., a leading North American cannabis company, reported its financial results for the fourth quarter and full year ended Dec. 31, 2024. All amounts are expressed in U.S. dollars and are prepared under U.S. generally accepted accounting principles (GAAP), unless indicated otherwise.

The following financial measures with respect to the full year 2024 are reported as results from continuing operations due to the shutdown of the licensed producer business in Canada, which is reported as discontinued operations through Sept. 30, 2023. All historical periods have been restated accordingly.

Fourth Quarter 2024 Financial Highlights

- Net Revenue was $74.4 million, compared to $74.2 million in Q3 2024, an increase of 0.3% quarter-over-quarter.

- Gross Profit Margin was 50.2%, up 140 basis points compared to 48.8% in Q3 2024.

- GAAP Net loss was $30.2 million, compared to a net loss of $21.4 million in Q3 2024; Q4 2024 net loss included a $45.4 million non-cash impairment charge related to the company’s Michigan business.

- EBITDA1 loss was $30.6 million, compared to $6.6 million in Q3 2024; Q4 2024 loss included a $45.4 million non-cash impairment charge primarily related to the company’s Michigan business.

- Adjusted EBITDA1 was $15.1 million, compared to $13.7 million in Q3 2024.

- Adjusted EBITDA Margin1 was 20.3%, compared to 18.5% in Q3 2024.

- Net Cash provided by operating activities was $9.7 million, compared to $1.8 million in Q3 2024.

- Free Cash Flow1 was $5 million, compared to $1.5 million in Q3 2024.

Full Year 2024 Financial Highlights

- Net Revenue was $306.7 million, compared to $317.3 million in 2023, a decline of 3.3% year-over-year.

- Gross Profit Margin was 48.9%, compared to 50.3% in 2023.

- GAAP Net loss from continuing operations was $72.7 million, compared to a net loss from continuing operations of $82.3 million in 2023; Net loss included $47.8 million and $58.1 million of non-cash impairment charges for 2024 and 2023, respectively, primarily related to intangible and fixed assets in the Company’s Michigan business unit.

- EBITDA from continuing operations1 was $3.3 million, compared to ($3.3) million in 2023.

- Adjusted EBITDA from continuing operations1 was $60.7 million, compared to $68.8 million in 2023.

- Adjusted EBITDA Margin from continuing operations1 was 19.8% compared to 21.7% in 2023.

- Net Cash provided by continuing operations was $38 million compared to $31.1 million in 2023.

- Free Cash Flow1 was $28.6 million compared to $23.4 million in 2023.

"The business performed ahead of our expectations in the fourth quarter,” TerrAscend Executive Chairman Jason Wild said. “For 2024, we generated $307 million in revenue, $61 million in Adjusted EBITDA from continuing operations, $38 million in positive operating cash flow, and $29 million in free cash flow. This performance was driven by our ability to achieve a No. 1 market share position in New Jersey for all quarters of 2024, growth of our business in Maryland from negligible revenue in early 2023 to a fourth-quarter 2024 run rate of over $70 million, while surpassing 50% gross margin, as well as improved gross margin in Pennsylvania, a state that I am particularly excited about in anticipation of proposed adult-use legislation

"During the year we completed a non-dilutive debt financing, aided by our $150 million of owned real estate, extending the vast majority of our debt maturities to late 2028. All of these accomplishments in 2024, including achieving our tenth consecutive quarter of positive operating cash flow and sixth consecutive quarter of positive free cash flow, give us confidence in our ability to drive operational efficiencies and growth of our core business while judiciously pursuing multiple greenfield expansion opportunities at increasingly attractive prices.”

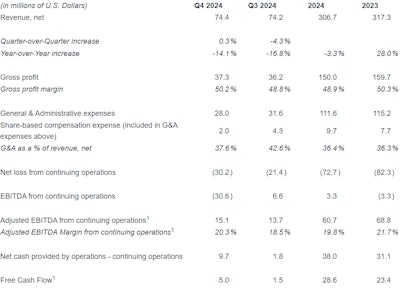

Financial Summary Q4 2024, Full Year 2024 and Comparative Periods

All comparative figures have been restated to reflect the classification of the Canadian business as discontinued operations through the third quarter of 2023. Financial results from the fourth quarter of 2023 onward reflect only continuing operations.

1. EBITDA loss, EBITDA from continuing operations, Adjusted EBITDA, Adjusted EBITDA from continuing operations, Adjusted EBITDA margin, Adjusted EBITDA margin from continuing operations, and Free Cash Flow are non-GAAP measures defined in the section titled “Definition and Reconciliation of Non-GAAP Measures” below and reconciled to the most directly comparable GAAP measure, at the end of this release.

2024 Business and Operational Highlights

- Achieved 10th consecutive quarter of positive operating cash flow and sixth consecutive quarter of positive free cash flow in the fourth quarter of 2024.

- Signed definitive agreement to enter the company’s sixth state with the acquisition of Ohio Ratio Cannabis, a well-situated and currently profitable dispensary in Ohio. The transaction is expected to close in the coming weeks, subject to regulatory approval.

- Maintained the No. 1 market share position in New Jersey every quarter in 2024, according to BDSA.

- All three New Jersey Apothecarium retail locations were ranked in the top 10 out of approximately 200 locations in the state, according to Lit Alerts2.

- Commenced expansion of cultivation and manufacturing in Boonton, N.J., to support innovation and enable a broader product portfolio to meet consumer demand.

- Revenue grew sequentially in Maryland for all four quarters of 2024 while expanding gross margin from 25% to over 50%.

- Increased market share position in Maryland from No. 13 in the fourth quarter of 2023 to No. 6 in the fourth quarter of 2024, according to BDSA. The company is now only 1.9 market share points away from a No. 2 position in the state.

- Initiated expansion of Maryland cultivation facility by adding four additional grow rooms with the first harvest expected during the second quarter of 2025.

- Commenced preparation for anticipated Pennsylvania adult-use implementation, leveraging the company’s 150,000-square-foot cultivation and manufacturing facility and Apothecarium retail network of six dispensaries.

- Closed on a senior secured term loan for gross proceeds of $140 million, carrying an interest rate of 12.75%, maturing in August 2028 and containing no warrants or prepayment penalties. The terms of the loan were aided by the company’s approximately $150 million of owned real estate.

- Initiated the first-ever share repurchase program in August 2024.

- Implemented a company-wide ERP system, enhancing efficiency across departments and providing improved data visibility and control.

- Completed a series of initiatives that are expected to reduce General & Administrative expenses year-over-year by at least $10 million in 2025.

- Appointed Lynn Gefen, TerrAscend’s chief legal officer, to an expanded role as chief people and legal officer, and corporate secretary.

2. Data based on total units sold during the fourth quarter of 2024.

Fourth Quarter 2024 Financial Results

Net revenue for the fourth quarter of 2024 was $74.4 million as compared to $74.2 million for the third quarter of 2024, representing quarter-over-quarter growth of 0.3%. This growth was driven by the company’s No. 1 market share position in New Jersey combined with sequential revenue growth in Maryland for the fourth consecutive quarter, partially offset by retail decline in Michigan.

Gross profit margin for the fourth quarter of 2024 was 50.2% as compared to 48.8% in the third quarter of 2024. The quarter-over-quarter 140 basis-point expansion was driven by improvements in Maryland and Pennsylvania while New Jersey remained relatively flat quarter-over-quarter.

General & Administrative expenses (G&A) for the fourth quarter of 2024 were $28 million as compared to $31.6 million in the third quarter of 2024. The $3.6 million sequential decline in G&A expenses was driven by a $2.3 million reduction in share-based compensation expense and $1.3 million of operating expense reductions.

GAAP Net Loss was $30.2 million, inclusive of $45.4 million of non-cash impairment charges related to the company’s Michigan business, compared to a net loss of $21.4 million in the third quarter of 2024.

Adjusted EBITDA, a non-GAAP measure, was $15.1 million, a 20.3% Adjusted EBITDA margin, as compared to $13.7 million, an 18.5% Adjusted EBITDA margin, in the third quarter of 2024. The quarter-over-quarter increase was driven by gross margin expansion and G&A expense reduction.

Full Year 2024 Financial Results

Net revenue for the full year 2024 was $306.7 million, compared to $317.3 million for the full year 2023. The year-over-year decline was mainly driven by a decline in retail sales in Michigan and New Jersey. The decline in retail sales in Michigan was driven by reduced foot traffic related to reductions in discounting and promotions driven by the company's ongoing efforts to expand gross margin. The decline in New Jersey was driven by an increase in retail competition related to store openings across the state. These declines were partially offset by wholesale revenue growth in New Jersey and Pennsylvania and both retail and wholesale revenue growth in Maryland due to a full year of adult-use sales and market share gains in that state.

Gross profit margin for the full year 2024 was 48.9% as compared to 50.3% for the full year 2023. The decline in gross margin was driven by price compression in New Jersey and Pennsylvania, partially offset by margin improvement in Maryland related to the company’s expansion and continued productivity gains and cost reductions in that market.

G&A expenses for the full year 2024 were $111.6 million compared to $115.2 million in 2023, representing a 3% decline in G&A expenses year-over-year. This reduction in G&A expenses was related to the company’s ongoing initiatives to optimize its G&A expenses. G&A as a percent of revenue was unchanged versus the prior year at 36.3%.

Net loss from continuing operations for the full year 2024 was $72.7 million compared to a net loss of $82.3 million in 2023. Both 2024 and 2023 included $47.8 million and $58.1 million, respectively, of non-cash impairment charges primarily related to intangible and fixed assets in the company’s Michigan business unit.

Full-year 2024 Adjusted EBITDA from continuing operations, a non-GAAP measure, was $60.7 million compared to $68.8 million in 2023. The year-over-year change in Adjusted EBITDA from continuing operations was driven by lower revenue and gross profit margin, partially offset by lower G&A expenses year-over-year. Adjusted EBITDA margin from continuing operations for the full year was 19.8% as compared to 21.7% in 2023.

Balance Sheet and Cash Flow

Cash and cash equivalents, including $600,000 of restricted cash, were $27 million as of Dec. 31, 2024, compared to $27.2 million as of Sept. 30, 2024. Net cash provided by operating activities was $9.7 million for the fourth quarter of 2024 compared to $1.8 million in the third quarter of 2024. This represented the company’s 10th consecutive quarter of positive cash flow from continuing operations. Capex spending was $4.7 million in the fourth quarter of 2024, mainly related to the company’s expansions at its facilities in New Jersey and Maryland. Free cash flow was $5 million compared to $1.5 million in the third quarter of 2024, representing the company’s sixth consecutive quarter of positive free cash flow. During the quarter, the company distributed $2.9 million to its New Jersey partners and made $1.4 million of principal payments on its debt.

As of March 5, 2025, there were approximately 369 million basic shares of the company issued and outstanding, including 292 million common shares, 13 million preferred shares as converted, and 63 million exchangeable shares. Additionally, there were 43.1 million warrants and options outstanding at a weighted average price of $3.90.