Cannabis delivery sales are a growing share of the cannabis market, a trend that the COVID-19 pandemic accelerated during 2020.

Due to homebound users, safety, dependability, and convenience, cannabis delivery will likely continue to prosper long-term. And with ticket sizes trending 2x higher than in-store dispensary order sizes, it's unquestionably a significant revenue opportunity for retailers looking to start a dispensary delivery service.

With many key players in the cannabis industry turning to delivery for the multiple upsides, competition has never been higher. Businesses that are either hoping to expand, improve, or simply build out a delivery service need answers to plan efficient routes, meet consumer needs, promote their services, and provide a superior customer experience.

So where do we look for these answers? In the data, of course. Understanding cannabis delivery data is essential to providing a best-in-class delivery experience, reaching new markets, and growing your business.

In this article, we’ll be looking into cannabis delivery data in the top-selling cannabis state in the US, California.

So what are delivery times that dispensaries can expect to accommodate?

Here, we’ll take a look at delivery time averages. A delivery data sample from the Bay Area shows that typical delivery times at higher customer-retained businesses are, on average, 30-75 minutes depending on geography, with a delivery time spread between drivers at about 50%. This spread is consistent even if a delivery service has an overall average delivery time that is low as compared to one that is higher, as the spread doesn't cover certain delivery services being over exposed to longer distances here.

Another factor to consider is the relationship between orders per hour and delivery times. Across our whole sample, the average driver completes 2.5 orders per hour (13 orders in a 10 hour shift), which spreads between 1.5 and 3.6 orders per hour. This would mean that longer times can result in less revenue, but we also looked at corresponding ticket sizes to see if fewer orders always means less revenue, or if ticket sizes can make up for fewer orders.

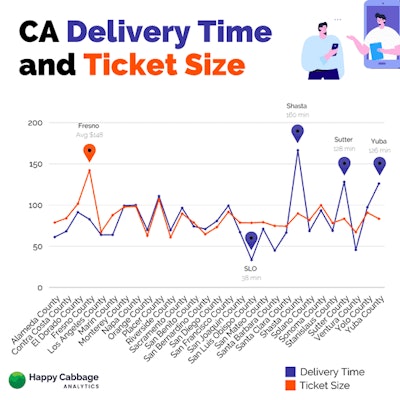

The graph below covers delivery across CA counties. We’re excluding pre-orders here to see direct correlation between fulfilled orders and in-person delivery.

delivery ticket size

delivery ticket sizeWith ticket sizes across the sample averaging at about $84.31, Fresno is one outlier to keep an eye on. Their $148.18 order average and 69 minute average delivery time further skews any potential correlation between ticket size and delivery time.

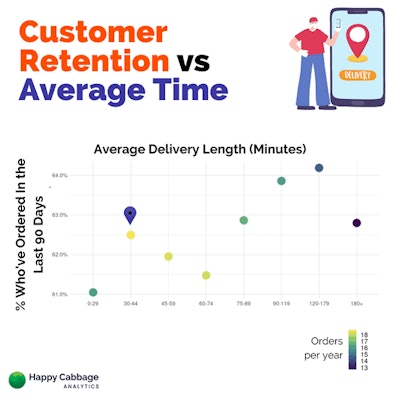

Does delivery time affect overall consumer retention?

Of course, cannabis delivery times vary greatly dependent on multiple factors- size of delivery zones, available dispensaries in given markets, traffic, order size, numbers of orders to fulfill, delivery model (ice cream truck model versus pizza model), etc.

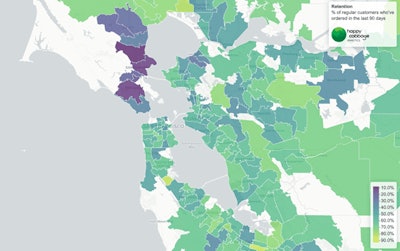

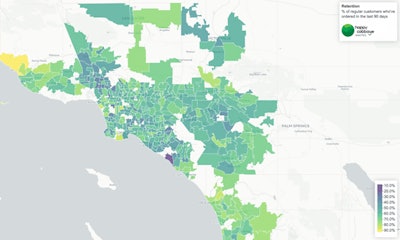

Looking at dispensary customer retention rates here is interesting because customer order frequency and latency indicate whether a consumer is “used to” a specific order time. Customer retention is a good measure for ensuring that customers are consistently making purchases, and not heading over to competition. What distinguishes a retained customer from a non-retained customer is the former makes an order at least every 90 days.

When it comes to retaining delivery customers, simply getting it to the customer faster doesn’t necessarily mean they will be higher retained. On average, most customers in the Bay Area receive their cannabis 1-2 hours after placing an order.

What we find is that customers who get their deliveries faster (in less than an hour) actually don’t necessarily repeat purchases as often as customers who get delivery after an hour long wait time. They order at a lower overall frequency (orders per year) and have a lower retention rate.

How could this possibly be? It’s important to note the role of geography in customer retention.

Customers in more densely populated areas who may be experiencing faster delivery times could have more options to choose from. With more options, customers are more likely to shop around for the best deals, fastest delivery, lowest service fees, etc. Compared across the Bay Area, less densely populated areas have longer delivery times (as expected).

san francisco county delivery times

san francisco county delivery times los angeles county delivery times

los angeles county delivery timesBut those same less-densely populated areas are shaded lighter when looking at retention, meaning they actually retain more customers than more densely populated areas, implying the causal factor might not be delivery times, but availability of cannabis options.

So back to our question- does delivery time correspond to customer retention? Not exactly. But customers do tend to make more annual purchases to cannabis businesses who deliver orders between 30 and 75 minutes.

Happy Cabbage Analytics provides data analytics and insights solutions for cannabis retailers. Learn more about their latest platform for delivery businesses, Sirius.