As the acceptance for cannabis grows, so will dispensary competition. While cannabis companies continue to legitimize and professionalize, business owners must also place an emphasis on customer service, marketing and data to attract customers and keep them coming back.

Loyalty programs are a marketing strategy commonly used in most industries. Airlines dole out frequent flyer miles. Hotels offer points for stays. Credit cards give cash back, and chances are, your local coffee shop surrenders a free latte after an arbitrary number of purchases. These programs help retailers accomplish their goals of attracting, keeping and rewarding customers.

In the cannabis industry, loyalty programs are starting to gain traction—and for good reason. Reflecting overall retail trends, repeat customers account for roughly 80 percent of a dispensary’s revenue; they are five times more likely to refer new business and spend approximately 60 percent more per visit, according to Joel Milton, CEO and co-founder of Baker Technologies, a cannabis software and customer relationship management (CRM) provider. Loyalty programs reward customers for their business, encouraging them to become repeat buyers.

The Basics of Loyalty

A loyalty program serves many purposes. It rewards customers for brand loyalty through special offers, incentivizes new customers to visit and develops a devoted client base. These offers typically are packaged deals, discounts, free merchandise or early access to new products.

Dispensary owners and loyalty program vendors agree a loyalty program is not a way to clear out surplus. Nor is it a way to push low-quality strains that aren’t selling or edible products nearing their expiration date. It’s also not the correct platform to try to force products onto customers who don’t want them. The key to a loyalty program is giving the customer something of real value; otherwise, it will become obsolete. It doesn’t have to be a product or deal directly related to cannabis, either.

“Chances are the guy that spends $500 a week in your store isn’t interested in a free joint once a week or once a month,” says Gary Cohen, CEO of Cova, a Denver-based cannabis CRM and point-of-sale (POS) platform. “But if you could invite him to get a massage from a licensed masseuse for every $500 he spends … you’ve created a loyal customer.”

How Can a Loyalty Program Succeed?

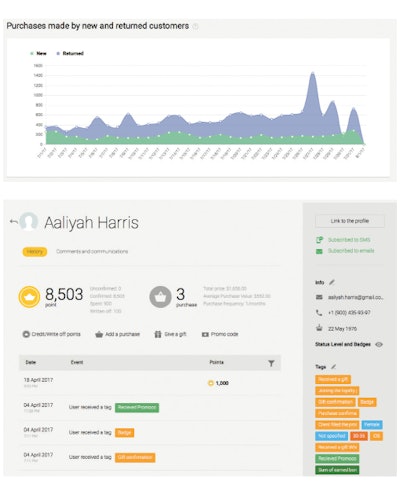

The obvious answer is customers and attractive offers, but it’s more complicated than that. For a loyalty program to be truly successful, the issuing dispensary needs to collect and analyze vast amounts of data, such as buying patterns, average transaction amount and the number of times a customer visits during a specific time period. A company can then leverage this information to make tactical and informed business decisions.

“Data has been referred to as ‘the new oil’—the world’s most valuable resource,” Milton says. “In the early days of the cannabis industry, it was possible to succeed without leveraging data. As the industry matures, the most successful dispensaries will be the ones who use data to make informed business decisions.”

Data helps dispensary owners determine what their customers want and which types of rewards to offer. “For example, if pre-rolls are a big sales category, a great loyalty reward would be a lighter—an item that is relevant to the category,” Milton says. “Without using data, it is possible that an item at a similar price point, like papers, would have been delegated as a reward.”

“With our data and reporting, I can see what the sales trends are, see what our most popular stuff is, see that maybe some strains are better, or more popular, as a concentrate than as a flower,” says Pamela Reach, CEO of Rare Dankness Industries, which operates House of Dankness, a vertically integrated medical and adult-use dispensary in Denver. “If I can see that ‘A,’ ‘B’ and ‘C’ are selling, but ‘O’ and ‘N’ aren’t, I need to get those off the menu and find something my customer wants.”

However, there is an industry-wide problem around collecting customer data, according to Milton. Recreational cannabis dispensaries are unable to collect detailed information on their shoppers due to regulations. And, “depending on the state you’re in, the laws are different as to how you can collect data,” say Arnab Mitra, marketing manager at Sailplay, a customer loyalty platform.

“Data has been referred to as ‘the new oil’ – the world’s most valuable resource.” Joel Milton, CEO, Baker Technologies

As many dispensary owners know, many customers don’t readily provide information because of the stigma that continues to envelop cannabis, or for their own privacy reasons. But pestering customers for their personal information won’t be effective. “Customers say, ‘I just want to come in and buy something. If your store is going to pound me for information, I’m not coming to your store,’” Cohen says.

The best approach is to collect and use data that customers willingly offer. “A client isn’t going to fill out a 20-page questionnaire about who they are and everything they like,” says Mark Breen, vice president of business development at Leafbuyer Technologies, an online cannabis deals database. “But most of them will share what types of products they are interested in.”

This is exactly the type of data that dispensaries need. Dispensaries are not necessarily looking for a client’s demographics, education or social security number. Rather, according to Cohen, dispensaries are mainly looking for data on products (what sells, what doesn’t), customer behavior (when do people come in, how much they spend) and return on marketing investments. Partnering with the right software company can make collecting and leveraging this data easy, he says.

How to Implement a Loyalty Program

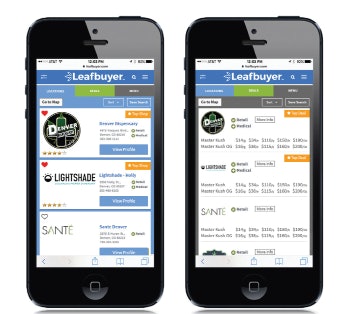

Integrating a loyalty program into your dispensary without help can be an arduous task due to the complexities of data collection and program structuring. Luckily, there are tech companies focused on making data collection and loyalty programs hassle-free for dispensaries. Baker, Cova, Leafbuyer and Sailplay are a few examples.

All four companies offer a unique line of products and services that go beyond what is mentioned below. Leafbuyer, for example, publishes dispensary deals online and allows patients to sign up for loyalty programs before they ever walk through the door. Cova offers digital showroom signage that integrates with point-of-sale (POS) systems to ensure dispensaries are marketing in-stock products. Baker enables online ordering and real-time analytics, while Sailplay handles email and short message service (SMS) text messaging campaigns. They all provide detailed, segmented reporting and structured loyalty programs as well.

“We want to be able to provide dispensaries with a differentiating factor between themselves and another dispensary,” Mitra says.

Each also provides CRM tools such as real-time digital dashboards that reflect sales, inventory and customer information. Most companies will also help dispensary owners understand the different ways they can use data beyond loyalty programs.

“If I know that people who buy ‘X’ also buy ‘Y’ 25 percent of the time, then maybe I put ‘Y’ right next to ‘X’ in the store,” Cohen says. “That is when you start running your store with analytics, when you’re using your data to optimize your opportunities in-store. That’s how you get smart with data.” Data can be analyzed to determine when a dispensary should have more budtenders on duty, and can be leveraged to turn a shopping experience from transactional to relational by greeting customers by name when they check in and asking how they enjoyed a specific product they recently purchased.

Since all cannabis software companies have different product lines and price points, no one company is necessarily better than another. Dispensary owners should assess their needs, scour the marketplace and partner with the company that is best aligned to help them meet those needs.

Are All Loyalty Programs the Same?

Loyalty programs come in all shapes and sizes. Having one is great, but having the right one is better. After a dispensary decides to implement a loyalty program, the next step is determining how to structure it. This is paramount because, “if you don’t have your points and rewards strategy structured correctly, then you’re wasting your money with loyalty,” Mitra says. Should the program offer points or predetermined products? Should it be based on visits or dollars spent? Is there a reward for client referrals? Unfortunately, there is no playbook.

“If you reward your customers for bringing in a new customer, then you expand your clientele,” says Faai Steuer, senior marketing strategist at Cova. “If you reward based on the customer’s purchase, then you’re increasing cart size and revenue. It all depends on how you want to implement your marketing strategy.”

One way to determine a strategy is to identify through data what customers truly value. “Loyalty programs need to be designed with customers in mind,” Milton says. “If the program only focuses on business needs, customers will respond poorly.”

When setting up its loyalty program, New England Treatment Access (NETA), a vertically integrated medical dispensary in Massachusetts, determined that high costs were deterring patients from registering for medical cards. NETA used this information to structure its loyalty program around making obtaining a card cheaper.

“These specialized doctors charge quite a bit to become a patient— $200 to $500 for the initial consult, and then another $200 annually,” says NETA marketing specialist Kim Napoli. NETA wanted to incentivize people not only to become patients, but to shop at NETA. As a result, it now gives patients $200 when they come into NETA within 30 days of becoming a patient or renewing their patient registration.

“This is for people who perhaps would not have purchased this type of medicine because they are on a fixed income. Obviously, healthcare doesn’t cover it. So to be able to give people money to help with the cost of becoming and staying a patient is really awesome,” Napoli says.

Get the Word Out

Communicating with loyalty members is essential, and dispensaries should be strategic in their approach. Text message and email are two effective ways to communicate with loyalty members.

Texts can be beneficial to provide the privacy that many cannabis customers desire. “The discretion of this industry is one of the reasons that this is so effective, because a text message is personal communication. If you want a personal communication other than face-to-face, you choose text message,” says Jeffrey Winaker, CEO of NorthText, an SMS marketing company with approximately 100 dispensary clients. “Only you and your phone know what you’re saying.”

Texts also can be less restrictive than social media marketing. However, there are certain laws with which dispensaries must comply. “If you have 10,000 patients on your list, you can’t just blast them all. That’s not legal,” Winaker says. “Text message communication requires a physical opt-in,” he says, meaning customers must agree to receive text messages.

There are also best-practices to abide by. According to Breen, many dispensaries using text-message marketing see a positive reaction rate and are tempted to send more messages. “You have to be careful. If you’re blasting people three to four times a day, they are going to say, ‘that’s too much,’” Breen says. “If you keep doing that all the time, then you start losing people because people start opting-out.”

House of Dankness has been using MariText, a cannabis texting service, to communicate with its loyalty members for several months. “Within the first hour of our first message going out, about four to five people came in that otherwise wouldn’t have,” Reach says. “So we saw results right from the start.” Reach adds that the customer feedback to the program has “been positive overall.”

According to Winaker, his clients typically see a 1- to 5-percent increase in foot traffic for a single message. For a text that goes to 1,000 members, his clients expect to see roughly 10 to 50 incremental walk-in customers.

Is a Loyalty Program Right for Your Dispensary?

A dispensary should consider its overall goals when deciding if a loyalty program is right for business. If retaining customers and lowering costs are priorities, a loyalty program may be able to help. According to consulting firm Lee Resource Inc., attracting a new customer will cost a company five times more than keeping an existing customer. Consulting firm Bain & Co. found that a 5-percent increase in customer retention can increase profitability by 75 percent, and that 80 percent of a company’s future revenue will come from 20 percent of existing customers.

“Customers want to feel valued by their dispensary, and if they don’t get that experience, there are many dispensaries trying to win their business,” Milton says. Based on the above statistics, making customers feel valued is well worth it.

A dispensary’s location also should be considered when contemplating a loyalty program. In less saturated markets such as the East Coast, where dispensaries are not as ubiquitous as on the West Coast, the need for a loyalty program may not be as dire.

“Right now, there are so few dispensaries in Massachusetts that I don’t think a loyalty program is essential, but it’s a good idea,” Napoli says. “When NETA opened in Westhampton, it was two hours from the next closest dispensary, so you didn’t need a loyalty program.” Today, there are 12 dispensaries operating in Massachusetts.

In hyper-competitive markets, a loyalty program can be the difference between years of prolific business or closing up shop. “Loyalty is essential in California,” Cohen says. “You have a handful of licensed dispensaries, and then around those you have a ton of unlicensed dispensaries. So if I’m a dispensary and trying to hold onto customers, I have to provide something to pull them back in. A loyalty program is a good way to do that.”