Choosing the right entity in which to conduct your business could be one of the most important decisions you make. In my opinion, it is even more important to businesses in the cannabis industry. The usual deciding factors don’t always apply to this industry. There are many traps for the unwary, so it’s crucial to enlist the services of qualified professionals to help you make this decision.

There are three main options to consider: limited liability company (LLC), S Corporation and C Corporation. Truthfully, there is a fourth option—a sole proprietorship—but I would never recommend operating any business as a sole proprietorship. Doing so could expose you to unnecessary personal liability. Let’s explore the first three of these options in greater detail.

Limited Liability Company (LLC)

An LLC is a popular and flexible entity type. It is known as a pass-through entity, which means the company itself does not pay any tax on its income. Instead, members of the LLC pay tax on their share of the company’s income that passes through to them. The income that passes through to the member is also subject to self-employment tax if that member is working in the business. The flexibility of the entity allows for multiple classes of membership. For instance, one could have multiple investor class memberships (voting and non-voting), founder memberships and so on. Also, profit and loss sharing and distributions don’t necessarily have to follow ownership percentages on a year-by-year basis. They eventually need to be trued-up, but not every year.

S Corporation

An S Corporation is also a pass-through entity, but it is not as flexible as an LLC. Members of an LLC or C Corporation can be corporations, S Corporations, another LLC or even trusts. This is not allowed for S corporations. All shareholders of an S Corporation must be individuals. Distributions to shareholders must be pro rata (a proportional allocation) based on shareholder ownership. Only one class of shares is allowed.

There is also a requirement that a “reasonable” salary be paid to owner/operators of an S corporation. Under normal circumstances (non-cannabis business) this isn’t a problem. However, in a cannabis retail business, many salaries are either nondeductible or partially nondeductible due to the stipulations of IRS Tax Code 280E. This can have the unfortunate consequence of doubling the tax rate on shareholder employee salaries. If the salary is nondeductible, the income of the company that passes through to the owner is higher by that amount and the owner employee must include the W-2 salary in their income. Effectively, that amount is taxed twice. (Editor’s Note: For more on this and how the cannabis industry is fighting back, read “See You in Court,” Cannabis Business Times, February 2018.)

The reasonable salary requirement for S Corporations is important to note. If upon examination by the IRS it was determined that the owner employee was not taking a large enough (reasonable enough) salary, the double-tax problem could become much larger.

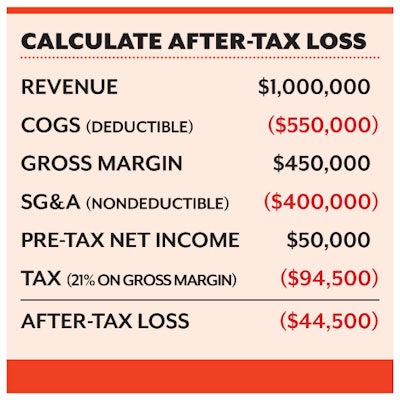

Section 280E of the Internal Revenue Code states that if you are in the trade or business of trafficking a controlled Schedule I or II substance as defined by the Controlled Substances Act, then you are only allowed to take cost of goods sold (COGS) as a deduction against income. Unfortunately, this leaves cannabis retailers in a situation where many of their expenditures are not deductible for tax purposes. You could find yourself in a situation where your economic income could be relatively low, yet your taxable income is much higher. The example on pg. 74 illustrates this point.

C Corporation

The third option is to conduct your retail business as a C Corporation. In my opinion, this is the preferred vehicle to operate a medical dispensary or recreational cannabis store. A C Corporation is not a pass-through entity like an LLC or S Corporation. It is a tax-paying entity. The shareholders, therefore, are not individually liable for the taxes of the C Corporation.

In the previous example, even though the company is profitable on a pre-tax basis, it experiences a loss after taxes. This is because the selling, general and administrative expenses (SG&A) are nondeductible for tax purposes. The tax is computed on gross margin rather than pre-tax net income. Therefore, it’s wise to use the C Corporation vehicle to contain the tax liability inside the corporation. If you were to operate your business as a pass-through entity (LLC or S Corporation) the tax liability would fall to the individual members or shareholders. If there was difficulty paying the tax, you could potentially expose your other assets outside of the business to potential liens or levies from the IRS. Because the C Corporation is a tax-paying entity, the tax liability stays with the corporation and does not pass on to the individual shareholders. Using the C Corporation therefore gives the business owners some protection from this scenario’s downside.

I would like to point out that the C Corporation is not as tax efficient as a pass-through entity because there are two levels of tax to be paid. Once at the corporate level and then again at the individual level when wages or dividends are paid. However, it is likely worth this inefficiency to protect the individual shareholders from the above scenario.

Another item to consider when using a C Corporation is the low-salary and high-dividend strategy. Since most salaries in a cannabis retailer are either completely or partially nondeductible, it doesn’t make sense to pay an owner/operator a large salary. Dividends are also nondeductible by the C Corporation, but they are taxed to the individual shareholder at a lower rate than wages.

No matter what form of business entity you choose, make sure that you have a written operating agreement or shareholder agreement if you have business partners. A good business attorney can help with this. The agreement should spell out the duties and obligations of each member or shareholder. These should include management of the business, sharing of profits, distributions, voting rights, transfer of an interest, dispute resolution and termination or dissolution of the business.