When vape cartridges first hit the market in 2014 with Colorado’s kick-off of adult-use cannabis, they represented a small slice of the cannabis pie. By the end of that year, vape cartridges and disposables captured just 3% of the state’s cannabis market. Sales reached $115 million.

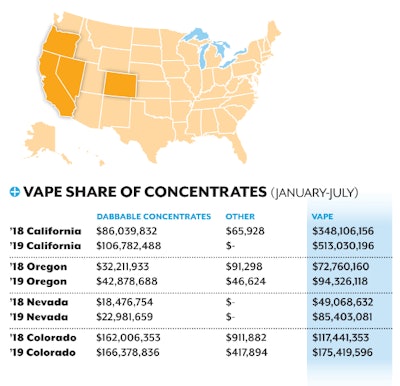

That was then. During the first seven months of 2019 in the combined Western adult-use states of California, Colorado, Oregon and Nevada (excluding Washington), vape sales represented one quarter of the market. Sales during the period reached $1.2 billion.

Vapes are a big part of the entire U.S. cannabis marketplace, nearly equal with flower sales in terms of dollars spent.

But consumer demand for different vape products is not uniform among states. In fact, big differences exist.

In California, for example, vapes capture 83% of the concentrates market, compared with 17% for dabbable products like shatter, wax and live resin. In Nevada, vapes nab 79% of the concentrates market, and in Oregon they capture 69%. And then there is Colorado. Vape sales in the Centennial State represent just 51% of the concentrates market, compared with 49% for dabbables.

Coloradans clearly enjoy their dab rigs. And Californians are crazy for vapes.

Disposables

Another point of interest is Nevada’s unique embrace of disposable vapes. All vape products in the states under review are divided into two broad categories: Cartridges of THC concentrate that are fitted into pens and replaced when the concentrate runs out; and disposables, in which the pens themselves are filled with concentrate. With disposables, the entire pen gets tossed when it is empty.

In California, disposables represent 13% of the market. Sales of disposables harness just 11% in Colorado and 6% in Oregon.

But in Nevada, disposables comprise 24% of the vape market.

Why? One theory is that it’s related to Nevada’s tourism volume. Visitors might not be keen on buying a pen as well as a separate cartridge and then tossing them both before they hop on a plane back home. A disposable vape, which is a good bit cheaper, might be more appealing to visitors.

Distillate Sales on the Rise

Another interesting vape trend revolves around the market growth of distillate and the toll that growth has taken on oil.

In Colorado, for example, during the first seven months of 2019, sales of distillate cartridges rose 80%, hitting $104 million. Oil cartridges are down 26% to $21 million. In Oregon, oil sales fell 15%, and in Nevada sales are flat. Oil cartridges did rise 15% in California, however. But at the same time, sales of distillate cartridges rose 49%.