With cannabis still federally illegal, a lack of banking has become a pain point for many retailers that must deal with cash or find other unique workarounds. Eric Kaufman, chief revenue officer at Dama Financial, explains some ways cannabis-related businesses can navigate tough banking laws and achieve financial success through banking.

1. Why is it so difficult to access transparent banking in the cannabis industry?

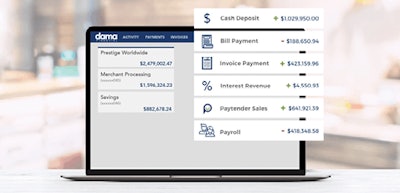

Because cannabis is a high-risk industry, there are enhanced compliance requirements that, frankly, banks don’t know how to handle. Dama Financial and its partnering FDIC-insured banks offer compliant banking and payment solutions to cannabis-related businesses (CRBs). Dama Financial manages the compliance program, due diligence, customer support and operations on behalf of its partnering financial institutions.

2. If passed, how will the SAFE Banking Act affect the industry?

As written, the act has a lot of vulnerabilities that persons with less-than-ideal motivations could seek to exploit. That said, we need clear rules and regulations that recognize the high-risk nature of the cannabis industry. In this environment, banks would need to drastically bulk up their compliance teams, and many may not be equipped or willing to make that effort, which is where Dama comes in.

3. What are some workarounds to cannabis banking?

CRBs hear of quick fixes and workaround solutions that work until they get shut down for being noncompliant. And when the accounts are shut down, it’s incredibly disruptive to the business. For example, think about how infrequently you change your personal bank account because it’s such a hassle. Now imagine having to do this for your business. Other companies will hold your money or steal it, create shell accounts, or not provide you with bank routing numbers. Businesses need a sustainable, transparent and compliant solution to allow their business to run efficiently, which is what Dama Financial is providing.

4. Is it truly illegal for banks to serve CRBs since marijuana is federally illegal?

The U.S. Treasury acknowledged a relationship between financial institutions and legal CRBs through its release of the FinCen guidance. The guidance states that serving CRBs is a risk-based decision and that thorough customer due diligence is a critical aspect of assessing whether a CRB implements the Cole Memo priorities or violates state law. Dama exceeds the regulatory compliance requirements and can therefore offer CRBs access to transparent banking solutions.

5. What are the dangers of operating in cash?

Cash is not only inconvenient but can pose major security risks. Cash allows human error when counting, as well as the constant threat of theft. It’s also expensive. Moving from a cash-based economy to a banked and digital economy is the future of the industry and will allow businesses to thrive.

For more information, visit damafinancial.com

_fmt.png?auto=format%2Ccompress&fit=crop&h=141&q=70&w=250)