Despite consumers’ off-site options, brick-and-mortar remains the cornerstone of cannabis retail. But the face and focus of retail locations continue to change, driven by forces as diverse as local competition, consumer behavior and multi-state goals.

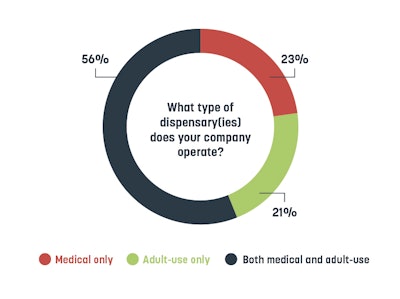

More than half of participants (56%) in this “State of the Cannabis Dispensary Industry Report” operate “both medical and adult-use” shops—up 10 percentage points compared to 2021, the first year Cannabis Dispensary conducted this research. The balance of study participants was a near split between “medical only” (23%) and “adult-use only” (21%) facilities. 2022’s dual-license increase drew most heavily from medical-only shops, down 13 percentage points from 2021.

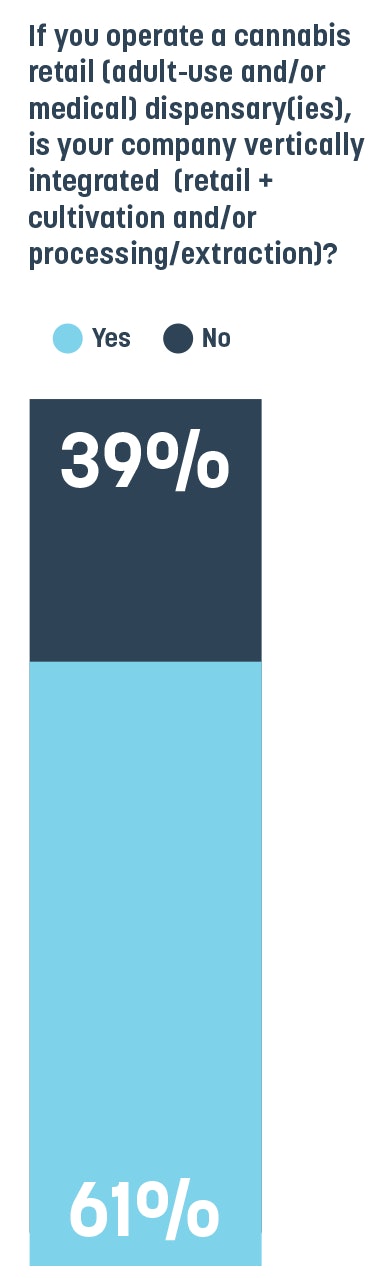

Vertical integration also increased for 2022’s cannabis retailers. More than 60% of research participants represent vertically integrated operations that span “retail plus cultivation and/or processing/extraction”—an increase of 11 percentage points from last year. But the number of retail locations held steady: 55% indicated they operate one location (adult-use and/or medical). At the other extreme, 5% of participants operate 31 or more locations.

Square footage in the “1,001 sq. ft. to 2,000 sq. ft.” range remained the most common size for dispensaries, cited by 36% of participants in this 2022 study. Stores with more than 5,000 square feet increased slightly to 7%.

About 60% of participants plan expansions, but they’re focused closer to home: 43% of companies plan to launch “a new retail location(s) in the state(s) or province(s) in which it currently operates.” But only 17% plan “new retail locations in a new state(s) or province(s) where it currently does not operate”—a decrease of 6 percentage points from last year.

Click here to view the 2022 State of the Cannabis Dispensary Industry Report.