VANCOUVER, July 2, 2019 /CNW/ - PRESS RELEASE - 1933 Industries Inc., a vertically integrated cannabis consumer packaged goods company that owns licensed cultivation and manufacturing assets to support its brands, has announced its Third Quarter Financial Results for the three and nine months ended April 30, 2019 (Q3).

Chris Rebentisch, chief executive officer, remarked, "Overall, we are pleased to report strong growth comparatively to our last quarter, driven by rising consumer demand for our AMA cannabis products in Nevada and the impressive growth of our Canna Hemp line throughout the United States, which is one of the largest growing cannabis markets globally. Since becoming a publicly-listed issuer two years ago, we have focused on building one of the most valuable and respected CBD brands in the market and in successfully growing THC market share in Nevada, where we continue to be one of the largest suppliers of wholesale branded products in the state, with a major presence in every dispensary. We have spent significantly on the expansion of our infrastructure to support the future growth of our brands and have increased spending in product development, inventory build-out and sales and marketing efforts."

Rebentisch added, "Our focus moving forward will be the growth of our consumer packaged goods portfolio and the continuous innovation of our unique, differentiated quality-based brands. We also intend to invest in our hemp extraction facility, automate our manufacturing processes and move into strategic markets. We have sustained organic growth with a strong platform, realized operational efficiencies across the organization and as our new assets come online to deliver higher capacity, we expect increased revenues and margins as we continue on the path to profitability."

Q3 Highlights

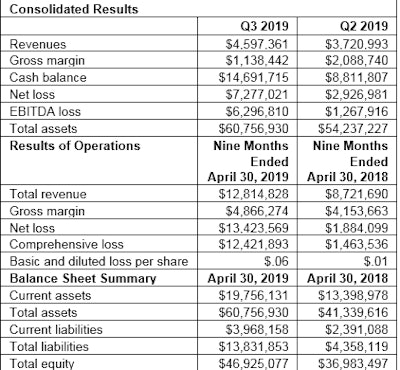

Revenue: The company delivered on recreational and consumer branded goods market platforms, resulting in quarterly revenues of $4,597,361, representing a 28-percent increase from the previous quarter and a 40-percent increase over the same period in fiscal 2018.

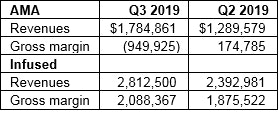

Gross Margin: Gross margin was $1,138,442 (24.8 percent) compared to $1,440,557 (43.7 percent) during Q3 2018. The decrease in the gross margin as a percentage of revenue from the prior year is primarily due to increased purchases of third-party biomass by Alternative Medicine Association (AMA) to produce concentrates and final products, while increasing market share. The company anticipates that its ability to cultivate sufficient amounts of biomass from its new facility to meet its production needs should lead to a material improvement in realized gross margins. Partially offsetting the increased costs of AMA, Infused MFG. (Infused) has significantly increased its customer base which has resulted in improved economies of scale in the production of CBD-based products, positively impacting overall gross margin, which exceeded 74 percent.

Net Loss: The company recorded a loss of $7,277,021, which is attributed to building infrastructure scale, investing in brand development and a $3,044,86 impairment adjustment of the company's consulting arm, Spire Global Strategy Inc. (Spire). The company acquired Spire on the basis of an independent valuation, a strong team and a solid business plan to provide services to the burgeoning cannabis sector in Canada and to build a diversified business within the cannabis industry. As the sector evolved in terms of both the regulatory environment and the nature and volume of contracts, the expected revenue and future market development of Spire were not realized. The company's strategy has since shifted to consolidate its focus on the nation-wide growth of its consumer branded goods and supporting cultivation and extraction assets, where the value proposition of these sectors to the business provides a better return on investment.

AMA revenues were $1,784,861 for Q3 2019 up 38 percent from the previous quarter, while gross margins were a loss of $949,925. Infused increased sales revenues to $2,812,500 for Q3 2019, which is an 18-percent increase from the previous quarter and accounts for 61 percent of the company's total revenues for Q3 2019. Year over year growth is $1,620.449, an increase of 136 percent. The increase in revenue over the previous quarter is primarily attributed to demand of AMA and Canna Hemp products which are differentiated by their premium quality and effectiveness, and are backed by the Company's leading customer service and education platforms.

Key Developments During and Subsequent to Q3

Infrastructure Buildout

The company received the permanent Occupancy Permit for its purposed-built, state-of-the-art indoor cannabis cultivation facility on June 28, 2019. The facility is now ready to commence operations, culminating in the achievement of one of the company's most important milestones in securing consistent supply of raw materials for its flower and concentrate branded products and white label production.

Increased Versatility and Output of Hemp Extraction Facility

The company intends to create a hemp processing facility with increased output capacity and versatility to work with additional cannabinoids. The company, in collaboration with a leading engineering firm, completed an extensive research and development phase to develop a customized design in order to provide for a larger, more efficient and more robust hemp processing facility than originally planned and designed in line with the new regulations and recommendations set out by the Agricultural Improvement Act of 2018, or Farm Bill, in the U.S. The fully customized processing facility will be one of Nevada's largest hemp extraction operations with 12,000 square feer of space, which the company believes will strengthen the its place as a major player in the booming CBD industry and will add a new significant revenue stream to its business model. The company announced plans to deploy a custom-built, ethanol extraction system with full chromatography abilities to allow for isolation of THC, CBD, CBN, CBG, CBC and several other cannabinoids, including the ability to produce full spectrum and broad-spectrum oils, as well as isolates, that meet required GMP standards. The increased capacity is estimated at a maximum monthly throughput of 68,000 kgs. of hemp biomass, producing approximately 5,000 kgs. of full spectrum oils or 4,500 kgs. of CBD isolate. The company intends to utilize all isolates in the manufacturing of its own proprietary CBD consumer branded goods, thereby securing the supply of raw materials, increasing its margins and benefiting from a recurring revenue stream from the sale to other manufacturers.

Coast to Coast Distribution Expansion

Infused continued to expand its reach across the United States by building its own distribution network into 46 states and selling its Canna Hemp wellness line into over 600 retail outlets, with the majority of these in California, Nevada, Arizona and Colorado. The number of retail outlets jumped to 800 by June, demonstrating the Company's ability to enter and expand its CBD-based offerings into new markets. The company continues to invest in product development as it transforms into a brand-centric company, gaining strength from its success in Nevada and expanding across the nation.

Growing Portfolio of Proprietary IP and Strategic Partnerships

With a growing portfolio of over 250 SKUs of THC and CBD-infused products, the company continues to bolster its product offering by attracting best of breed companies for strategic partnerships. The company signed three significant licensing agreements over the period with household brand names such as OG DNA Genetics, Birdhouse Skateboards and Gotti's Gold.

AMA signed a licensing agreement with OG DNA Genetics, a globally recognized leading cannabis brand, for the exclusive license to cultivate, manufacture, sell and distribute co-branded cannabis products for a two-year term in the State of Nevada.

Infused announced a partnership with Birdhouse Skateboards for the exclusive launch of co-branded hemp and CBD products geared towards the growing action sports market. The collaboration between one of the most respected skateboarding names in the world and Infused aims to develop several co-branded products, including CBD recovery creams and lotions, as well as hemp-only recovery creams and lotions which will be sold under Canna Hemp, Canna Hemp X and Birdhouse Skateboards names.

AMA strengthened its partnership with hip hop artist Kurupt for the launch of Gotti's Gold in Nevada, an exclusive premium collection of fine cannabis products intended to appeal to adult-users of all demographics, in order to meet the rising demand for cannabis products in the state.

AMA and Infused continued developing and creating unique brands with the launch of Canna Fused, a line infused with CBD and THC in a variety of ratios, featuring vape pens, cartridges, lotions and lip balms. Infused subsequently launched Endurance and Recovery Elixirs, under the Canna Hemp X line of sports action products and engaged professional athlete and mixed martial arts fighter Sarah Moras as a Brand Ambassador and sponsored-athlete.

Capital Raising Activities

Private Placement

The company closed a non-brokered private placement of 10,000,000 units at $0.45 per unit for total proceeds of $4.5 million, which was fully subscribed by one investor.

Asset Sale and Leaseback

After the end of Q3, the company closed a sale-leaseback transaction for the land and cultivation facility under construction in Las Vegas, Nevada. The company sold the assets for $14,027,035 (USD$10,450,000) less various adjustments for title fees, commission, and transfer taxes, which resulted in a net sale price to the company of $13,328,701 (US$9,862,700). After deductions for withholding, security deposit and rental payments, net proceeds to the company from the transaction were $11,981,956 (USD$8,926,437).

Warrant Exercise

The company advised its warrant holders that it was accelerating the expiry of warrants with expiry dates of April 24, 2019, May 17, 2019, June 14, 2019, August 16, 2019, and October 4, 2019, and that notice would be sent to its debenture holders with a maturity date of August 16, 2019, advising of its intent to force conversion of the balance of the debenture into common shares. The exercise of these warrants netted proceeds of $2,021,345 to the company.

Asset Purchase

Purchase of Remaining Interest in Infused

The company closed the acquisition of the 9 percent of the issued and outstanding membership interests of Infused that it did not already own, for a purchase price of CDN $1,248,000, payable through the issuance of a promissory note with a principal value of US$940,000 and the issuance of 7,000,000 common shares with a deemed share price of CDN $0.45. The note bears interest at a rate of 6.0 percent per annuum and is secured with 7 percent of the issued and outstanding membership interests of Infused. The purchase price also included the issuance of 1,000,000 non-transferable share purchase warrants with a strike price of $0.53, with an expiration date of March 29, 2021.

Corporate Governance - Organizational Changes to Fuel Growth

Board and Management Changes

- Brayden Sutton was named Chairman of the Board of Directors and stepped down as President and CEO

- Chris Rebentisch was appointed Chief Executive Officer

- Ester Vigil was named President

- Steve Radusch was named Chief Financial Officer, while Ryan Maarschalk resigned his position

- Caleb Zobrist was appointed Executive Vice President and remained Legal Counsel

- Terry Taouss was appointed to the Board while Mr. Andy Richards stepped down as Director

Strategic Advisor

CB1 Capital Advisors LLC, a New York-based advisory firm focusing on health and wellness through cannabinoids, was engaged as strategic business advisors for a two-year term. CB1 Capital Advisors focuses on companies in the supply chain of cannabinoid-based wellness solutions, products and therapies that have therapeutic or commercial use-cases. As an adviser, CB1 Capital Advisors provides strategic and business development advice to the company, including analyzing investment and partnership opportunities.

Marketing

The company embarked on a number of marketing and investment awareness programs, participating in over 20 conferences, trade shows and presentations across the U.S., Canada and Europe. The Canna Hemp line was featured in the Celebrity Gift Lounge during the 91st Academy Awards. The company launched The Dawn of a New Era, a short film chronicling the journey of cannabis from the dawn of civilization, through the origins of prohibition, to its new beginnings in modern society.

Detailed information on the financials and the management's discussion and analysis can be found at https://sedar.com/

Non-IFRS Financial Measures

The company has provided unaudited pro forma financial information. EBITDA and Adjusted EBITDA are non-IFRS measures and do not have standardized definitions under IFRS. The company has provided the non-IFRS financial measures, which are not calculated or presented in accordance with IFRS, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with IFRS. These supplemental non-IFRS financial measures are presented because management has evaluated the financial results both including and excluding the adjusted items and believe that the supplemental non-IFRS financial measures presented provide additional perspective and insights when analyzing the core operating performance of the business. These supplemental non-IFRS financial measures should not be considered superior to, as a substitute for or as an alternative to, and should only be considered in conjunction with, the IFRS financial measures presented herein.