Emily Paxhia

Emily PaxhiaBy Emily Paxhia

The cannabis industry is rapidly evolving, and in just one year we have seen changes that indicate that the sector is maturing and growing. While many facets of the industry have evolved, here are 5 key changes and what they mean for you:

- 1. Entrepreneurs are coming in from other sectors bringing their expertise in branding, marketing, design, tech, etc. This is very exciting, as it adds a whole new dimension to the industry. Additionally, their experiences in other business verticals are beneficial to the growth of the industry. Tech is one area we are seeing significant crossover. We are pleased to see this, as it is making access to cannabis easier for patients and enthusiasts. Technology allows for fans to link up around their passion for cannabis and to learn more about each strand, compound, etc. For investors, this provides opportunities to be involved with founders who have already had successful exits from other businesses or who have experience running a start-up. For entrepreneurs, this means the space is becoming more competitive, so it will require preparation and planning.

- Investors are becoming increasingly attracted to the space. Everyone took note when Peter Thiel invested in the industry, and we know countless other high-net-worth individuals, family offices, and angel networks that are now taking interest in this area. Investors: This means that good deals will become more crowded, so it will be critical to keep a finger on the pulse. For entrepreneurs, the expectations are that the business pitch and model will have to be solid. Investors will be asking tougher questions, and they will be savvy about valuations, fundraising, exits, etc.

- Companies in cannabis have had more time in the light, so they are able to show a financial track record and have a deeper understanding of what it means to run a cannabis business. For investors, this is a great thing, as it provides the ability to review a company in greater detail than this time last year. For entrepreneurs, this means being prepared for these more established businesses to have a stronghold on the market.

- More segments of cannabis users are emerging, and companies are starting to take note. Investors will have to consider who a product or service is designed to reach and what the potential market size is when evaluating companies. Entrepreneurs must engage in more nuanced exploration of the target audience. Market research is coming down the pike, which is used in many other industries and will be needed to understand this evolving sector.

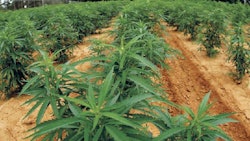

- More interest is arising for alternate growing methodologies, and research is increasing. For investors, this is an exciting time to be exploring technologies around growing efficiency. Growers are becoming more open to trying out alternative strategies, and this can result in good things for the bottom line. Entrepreneurs: This is an area that sorely needs improvement, and there is a bad rap forming around the energy use of the cannabis industry. Keep this in mind when considering business expansion or looking to provide solutions.

While all of these changes are signs that the industry is expanding, there are still barriers that have not moved as much. Here are five key areas that continue to be a bur in the side of the industry:

- Banking is one example of an area that remains stubbornly locked up, and the IRS has no sympathy for this pain point when it comes to paying taxes. Cannabis businesses are being denied access to traditional banking services, such as checking accounts, payroll support, loans, etc. For business owners, this results in more cash management, which is unsafe and leaves more room for accounting errors. This offers some opportunity for investors, as they can act as banks in the interim, providing loans.

- Cannabis remains federally illegal, which continues to be the big roadblock for distribution and requires complicated business structures for any brand that looks to expand across state lines. The state-to-state varying regulations also make for nuanced rules. For example, edible companies with certain guidelines in one state may have to adhere to very different guidelines in another state. Investors will need to understand these interstate issues when considering potential expansion. Entrepreneurs need to be aware that it will take some time, money and consideration to get interstate business plans and structures in place. Seeking counsel to properly establish these structures is likely a good idea. Also, be prepared to answer investors’ questions about distribution and expansion.

- Research is only available in a limited number of places, so the industry is struggling to get the word out about the potential beneficial compounds of the plant. There are some researchers, such as Sue Sisley who are managing to get the space and funding to do the work, but this needs to be brought to a larger scale. Investors: For now, decisions are based on smaller sample sizes and anecdotal reference around cannabis. For entrepreneurs, this means less access to reference points to support a theory and products.

- Misconceptions and misinformation are rampant in society. There are still many people who are fearful that cannabis is going to turn people into lunatics or will dull society into a stupor. We know this isn’t true, as there are many people who use cannabis who are in the most productive class of people. Investors today are the trailblazers, so it is wise to enjoy having access to deals until this perception changes and the space gets more crowded. Entrepreneurs: There is a smaller investor base and more work to gain buy-in on the potential of a product or service. For all in the industry, it means coping with frustrating opposition points that are based in nothing but fear and ignorance.

- There are still con artists running around the industry trying to get rich quick. These guys are bad news and are causing trouble for the industry. On the public side, they are destroying capital and feeding the perceptions that there are no real businesses in the cannabis world. Investors: Beware of people who have not taken the time to know or understand the space. Explore their exit strategies, and if there is a rush to public market exposure, be sure to understand the reasoning. Entrepreneurs: There are some people who will try to take the company public too early. This is dangerous, as it can destroy a business if it is not adequately prepared for that undertaking. Public markets are fantastic, as they provide access to capital and allow for non-accredited investor participation, but running a public company is a challenge with many factors. Be sure to know what it means to be a public company before going down that road.

Emily Paxhia is Founding Partner & Director of Relations for Poseidon Asset Management, where she focuses on analyzing cannabis companies and building relationships with entrepreneurs and investors. With 10+ years of experience working as a brand consultant and researcher, her work spans multiple categories and industries. Her clients have included McKinsey, Time Warner, Viacom, HBO, Participant Media, American Express and Comcast.Â