Over the past 10 years, the startup nature of the cannabis industry has attracted the angel investor as a key source of early stage capital for emerging private cannabis companies. Although angel investors generally provide smaller amounts of capital than family office or fund investors, the role of the angel investor in the cannabis industry is critical. This article examines the angel investor in cannabis and how this type of investor has evolved.

An angel investor is typically a private individual who provides capital for a business startup that is seeking its first round of funding. This type of funding usually takes the form of equity or convertible debt and us considered the riskiest type of capital due to the very early stage nature of the companies they invest in.

The 12 Business Sectors of the Cannabis Industry—and Which Ones Attract Angel Investors

In November 2014, Viridian published the first cannabis industry report that identified the 12 business sectors of the cannabis industry, as shown below.

The five sectors that attracted angel investors were:

- Consulting Services

- Consumption Devices

- Infused Products

- Miscellaneous Ancillary

- Software/Media

What are the factors that enables companies in these five sectors to attract angel investors?

- Low Capex: Startup companies in these sectors require relatively low capital expenditures and as a result lower amounts of startup funding. Since angel investors generally provide lower amounts of capital compared to family offices or funds, these sectors are ripe for angel investment.

- No State or Federal License Requirements: These five sectors don’t require state or federal licenses which are very expensive and time consuming, and often require “at-risk” capital. This compares to sectors that do require complex licensing arrangements such as Cultivation & Retail and Biotech.

- Low Start-Up Costs: Companies in these five sectors have low start-up costs enabling angel investors to provide the necessary startup capital.

- “Mom and Pop” Businesses: Consulting companies, infused products companies, advertising companies are often started without large staffing or office requirements, lending themselves to angel investors.

Public vs. Private Cannabis Companies and the Impact on Angel Investors

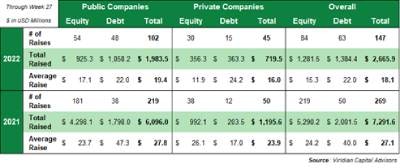

According to the Viridian Cannabis Deal Tracker, in 2021, public cannabis companies attracted 83% of all capital invested in the cannabis industry in 2021 vs. only 17% for private cannabis companies. This was the high-water mark for public companies since we began analyzing this in 2015. This meant that there were fewer opportunities for angel investors which by definition invest in early-stage private companies.

However, through the week that ended July 15, 2022, the amount of capital invested in private companies has materially increased, representing 31% of all capital invested in the cannabis industry, providing greater opportunities for the angel investor.

Why this turn?

- Public Cannabis Stock Prices Are Down: The average cannabis stock ETF is down over 50% YTD, meaning that there have been more investor outflows from public cannabis stocks.

- Private Cannabis Valuations Are Down Even Further: This has driven more angel investor interest from those early-stage investors wanting to invest in the industry and seeing less expensive entry prices.

- More States Enacting Medical and Recreational Cannabis Programs: This means that there are more early-stage, private cannabis investment opportunities in these states.

Due Diligence for Angel Investors

At Viridian, our principals have been advising, financing and buying/selling emerging growth companies for over thirty years. In the cannabis industry since 2014, we have reviewed over 2,500 business plans, business models and financial forecasts, and have been involved in hundreds of millions of dollars in financing and M&A transactions. We take due diligence very seriously—across management, operations, financials, reputation and experience.

Here are some keys:

- Management Experience: In a relatively new industry like cannabis, direct, legal business experience in the industry is rare. We look for prior success in startups where management has founded, scaled, funded and exited businesses.

- Funding Runway: Investors need to be cautious about the funding needs of a company they’re looking to invest in and whether the financing they’re participating in provides the required financing. No investor wants to be part of a company that is “under funded” and will have to raise additional, potentially dilutive, capital in the near future.

- Financial Forecasts: A company that an investor is looking at must have a set of high-quality financial forecasts that are well thought out, detailed, accurate and understandable. This reflects a management team that is experienced and focused on their business.

- Forward Thinking: A startup company is going to need several rounds of growth capital. Angel investors must be aware of potential dilution and negative effects of “next round” financings.