This proliferation of CBD consumers, and of increasing CBD use among existing consumers, is in part driven by the growing availability of CBD products. Most consumers have encountered hemp and CBD products at pharmacies, grocery stores, specialty stores and even gas stations. But which channels are consumers turning to most often?

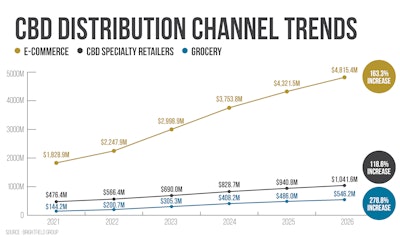

Brightfield Group anticipates consumers will purchase nearly $2.24 billion of CBD products through online channels in this calendar year. That is expected to more than double by 2026 to $4.8 billion.

Knowing where consumers purchase CBD products can inform hemp growers on which distribution partner to work with to maximize the odds of selling through their year’s supply. For example, if you mainly manufacture CBD for vape cartridges, it would not be ideal to partner with an online-only distribution business.

Let’s dive into Brightfield Group’s U.S. CBD distribution channel data to learn about the American CBD consumer.

Online Dominates, But Not Everywhere

Even before the COVID-19 pandemic saw us hermit ourselves away from one another, the ease of online delivery was already overtaking our lives. The same holds true for CBD products, with online channels such as CBD marketplaces and brand websites making up the plurality of total projected CBD sales for 2022. Brightfield Group anticipates consumers will purchase nearly $2.24 billion of CBD products through online channels this calendar year. That is expected to more than double by 2026 to $4.8 billion.

But not all product types are bringing in the most revenue from online sales. While Americans are fine with consuming CBD purchased through e-commerce channels, they prefer to obtain pet CBD products from pet stores—$261.6 million of pet CBD products are projected to be sold through pet stores in 2022, compared to $95.6 million purchased online. This trend is expected to maintain through Brightfield’s forecast period, with pet stores accounting for $394 million of pet CBD sales in 2026, compared to $166 million through online sellers.

Despite how much is written about the dangers of “gas station CBD,” that channel only accounts for $221.3 million of the CBD market, less than 4% of the total U.S. CBD market size.

Of note, CBD consumers spent the second-most on CBD drinks at natural food stores like Whole Foods ($95 million in 2022), making 24% of the drinks market. This indicates consumers are making drink purchases at stores where they pick up other health and wellness positioned drinks like Kombucha (which CBD consumers are twice as likely to consume compared to the general population, per Evergi data).

Brick and Mortar: Increasingly Turning to Trusted Sources

The top brick-and-mortar channels by revenue indicate that most consumers purchase their CBD at trusted locations. These include independent and retail pharmacies ($1.08 billion in 2022), where other health and wellness products often are purchased; specialty CBD retailers ($566.4 million in 2022), where consumers can receive information from clerks who can assist them navigating their options; and natural food stores ($461.7 million in 2022), again another channel where many health and wellness products are purchased.

Despite how much is written about the dangers of “gas station CBD,” that channel only accounts for $221.3 million of the CBD market, less than 4% of the total U.S. CBD market size. While the channel will continue to grow in size, it will keep in pace with the average industry growth and remain at less than 4% of the total CBD market by 2026 ($448.9 million).

Knowing where consumers are finding and purchasing CBD products can not only help you find the right distribution partners; It can also help you position your brand to appeal to occasions of use and need states. Thinking critically about consumer behavior will allow you to find budding market opportunities.

Brian MacIver is Senior Cannabis Insights Manager with Brightfield Group, where he oversees syndicated market and consumer research in the cannabis and CBD industries. A storyteller by trade and at heart, he was managing editor with Cannabis Business Times prior to his role with Brightfield Group.