As the COVID-19 pandemic began necessitating shutdowns and stay-at-home orders in the U.S. in March, some (including this author) postulated that cannabis consumers and patients may turn away from flower and inhalable products such as vapes in favor of edibles. Early findings show the novel coronavirus attacks the respiratory system, and health officials have warned that smoking or vaping of any kind can exacerbate infection.

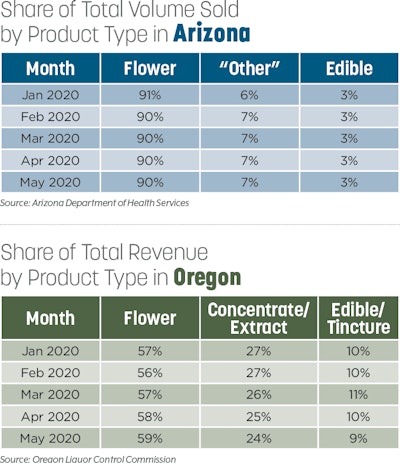

However, data from Arizona and Oregon reveals that this has not been the case among the general consumers who make up the overwhelming proportion of sales in Oregon nor the registered patients of Arizona’s medical system, one of the largest and longest-standing in the country. In fact, as sales have boomed overall in both states under the specter of COVID-19, the proportions made up by flower have increased slightly or held steady.

In Oregon, it appears the coronavirus pandemic has resulted in a boost to the already strong growth taking place. May’s sales total of more than $103 million is up 51% from January’s over $68.1 million in sales. (January 2020 sales were higher than May 2019’s totals for both Oregon and Arizona.) The increase in monthly revenue from flower sales from January to May was 58%, outpacing a 37% rise in revenue from sales of concentrates and extracts, along with a 43% expansion in sales of edibles and tinctures in that span.

Meanwhile, the proportion of sales revenue from flower has also grown during the months since COVID-19 gripped the country in March.

In Arizona, officials report sales for flower, edibles, and “other” (concentrates, vapes, and other products) by weight. Similar to Oregon, sales in Arizona’s medical market have reached unprecedented levels during the COVID crisis. May saw 18,083 pounds of all product types sold, a record high and up 18% from 15,302 pounds in January of this year. May’s flower sales volume represented an increase of 17% from January, in line with the total expansion in sales. However, May’s edibles sales were up only 4% in the same span, while sales of “other” products—which are primarily inhalable—had risen by 42%.

The Arizona data table shows that patients continued to purchase a similar variety of products even during the turbulence created by the coronavirus. Still, the market share commanded by edibles has contracted slightly when not rounding to the nearest percentage point; in April it stood at 2.7%, and in May it decreased to 2.5%.

Trends out of these two well-developed markets indicate that, despite warnings of smoking and vaping increasing the risk of infection and complications from COVID-19, the pandemic has not put a dent in the purchasing of smokable or inhalable products by either general consumers or registered patients. In fact, depending on the market one is operating in, demand for flower or vape products may have grown significantly relative to before the coronavirus. While it stands to reason that the current situation would potentially prompt an outsized increase in edibles sales, producers and retailers should always look to hard data to make well-informed decisions for their businesses.