America’s industrial hemp industry exploded this year after federal legalization in 2018. As in any new industry, there is significant uncertainty and volatility in wholesale prices, making attempts to value the U.S. hemp market difficult. But after speaking with state officials and market participants across the country, Hemp Benchmarks was able to generate six months of price assessments for CBD-rich hemp biomass, several forms of extracted CBD and other hemp products.

We have also formulated estimates of the volume of 2019’s hemp crop, its potential market value and the amount and value of crude CBD oil that could be generated from it. However, the estimated value may not hold up against the dramatic supply increase expected after the harvest. Our data already shows significant price erosion for many hemp product categories even before harvest.

Hemp Benchmarks estimates that 2019’s harvest will produce between 98 and 122 million pounds of CBD-rich biomass suitable for extraction. We value that amount of product at between $2.1 billion and $2.7 billion, based on assumptions of an average CBD potency of 8% and a wholesale price of $2.72 / %CBD / pound, our average rate for biomass in September.

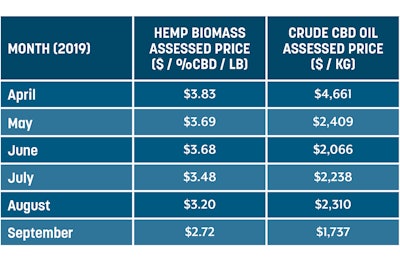

If prices erode, as many expect them to, the value of the biomass harvested this year will, of course, decrease. We already have observed biomass prices decline by 20% to 40% from April to September 2019, depending on transaction volume.

In producing CBD products, the first step is the extraction of crude CBD oil from hemp biomass. Based on our conversations with hemp processors, we estimate that between 1.96 and 2.44 million kilograms of crude CBD oil could be generated from the amount of biomass stated above. At September’s assessed price of $1,737 per pound, that amount of crude CBD oil would be worth between $3.4 billion and $4.2 billion.

Like biomass prices, rates for crude CBD oil have already eroded by large margins since we began reporting on it. September’s price for crude is down by 63% from April’s price of $4,661 per kilogram.

Crude CBD oil can then be used to generate refined hemp oil, which includes full-spectrum distillate and broad-spectrum (or THC-free) distillate, as well as CBD isolate. Prices for refined hemp oil and CBD isolate have also plummeted through the spring and summer months, with CBD isolate prices being hit the hardest.

Finally, there are questions as to whether the U.S. has sufficient infrastructure to dry and process the biomass from this year’s harvest. If not, it is possible that significant portions of the biomass could go to waste, reducing the potential value of the market, which would in turn cause contractions in the amount of CBD products that can be manufactured. This is all notwithstanding the downturn in wholesale prices that many market participants expect regardless.

Many are bullish on the industrial hemp and CBD markets, and not without reason. However, as our six months of assessing prices and reporting on the young U.S. hemp industry has shown, significant price erosion and a supply chain that is still under construction could seriously dent some of the sky-high market valuations that have been put forward.