COMMITTED TO THE CANNABIS CULTIVATION MARKET

Nexus Greenhouse Systems is proud to be the exclusive sponsor of this “State of the Industry” report, based on pioneering research on the cannabis cultivation market. Never before has this market segment been explored in such depth, and we are pleased to have made this research possible.

Since its beginning in 1967, Nexus has served and supported growers with innovative greenhouse and growing system designs. With our headquarters in Colorado, Nexus has been at the forefront of hybrid greenhouse designs. These designs are being developed by listening and working with cultivators from all over the country.

Educating our customers is a priority for us, whether by sharing our own expertise, built over half a century, or partnering on important educational efforts such as this landmark research project from Cannabis Business Times. Nexus believes the entire industry benefits when growers have the information to make the best decisions for their businesses.

We know the cannabis industry is battling high energy demands and the related costs. The good news is that Cannabis Business Times’ research shows businesses are getting smarter, utilizing significant cost- and energy-saving strategies such as automation technology and greenhouse cultivation.

In fact, as you’ll see in this report, 34% of respondents in the study say they grow at least in part in greenhouses. This is a tremendous increase from 5% a few years ago, showing that the use of hybrid, high-technology cultivation facilities are becoming an integral part of efficient growing practices. These facilities are secure and private with metal sidewalls and greenhouse roof coverings. By using natural light, energy usage can be up to 75% less in a greenhouse compared to an indoor grow. With greenhouse equipment technology, the grower has the ability to manage temperatures and humidity levels, exclude harmful insects, provide precise irrigation and fertilization levels, and engage in light deprivation to increase crop yields.

Nick Hice, of medical and recreational dispensary and cultivator Denver Relief, summed up greenhouses quite well: “Artificial lights are not ever going to be able to out-power the sun in the sunny months of the year. And the sun moves across the sky, which is good for the plants because it allows them to share the sunlight to a certain extent, and it allows us to grow bigger plants in a greenhouse since there is better light penetration.”

Greenhouse technology will have a positive impact as this industry matures. Nexus will continue to support educational efforts for our customers and the industry at large, and we look forward to building true partnerships with you and other cannabis cultivators, and helping you and the industry thrive.

— Greg Ellis, Director of Sales, Western States, Nexus Greenhouse Systems

Legal cannabis sales reached $5.4 billion in 2015,

a figure that represented a 73% jump over 2014. Sales are expected to grow 25% this year to $6.7 billion, according to industry investment and research firm ArcView — although that number seems conservative considering four or five states are likely to pass adult-use legislation this year. And many of us have seen the estimates that the industry could, in just a few years (if all states legalized), surpass the revenue generated by the NFL — with sales of $35 billion to $40 billion. This industry is not small potatoes.

Such eye-opening predictions aside, and despite the fact that California legalized medical marijuana 20 years ago, the industry, really, is in its infancy. Even California is facing a regulated market for the first time, and growers in The Golden State will be adapting and learning like everyone else.

The industry also still faces major challenges with the Federal Government. So, while growers are operating fully legal businesses in their respective states, the Fed’s illegal label on the plant causes many to continue to look over their shoulders, remain in the shadows and even use aliases when discussing their businesses in public or with the press.

Those challenges, combined with a lack of focus on cannabis producers, have left data wanting on this industry segment — the roots, so to speak, of the market.

Cannabis Business Times set out to remedy that by conducting research on cannabis cultivators, examining important trends, their facility choices and size, plans for growth, revenue generation, energy spending and more.

In this special “State of the Industry” report, we present to you the results of this important research project, managed by Readex Research, an independent third party and leader in market research. Here’s what we found.

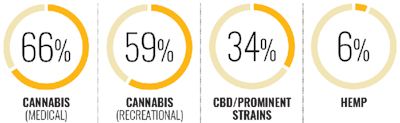

What types of cannabis plants does your operation grow?*

Small Businesses, Big Plans

Due to the recent expansion of the cannabis market,

with many new states legalizing medical marijuana programs, and four states now legalizing and regulating cannabis for adult use, it’s not all that surprising that many of the industry’s businesses are young. Based on the research findings, 60% of state-legal cultivation businesses have been in business less than three years.

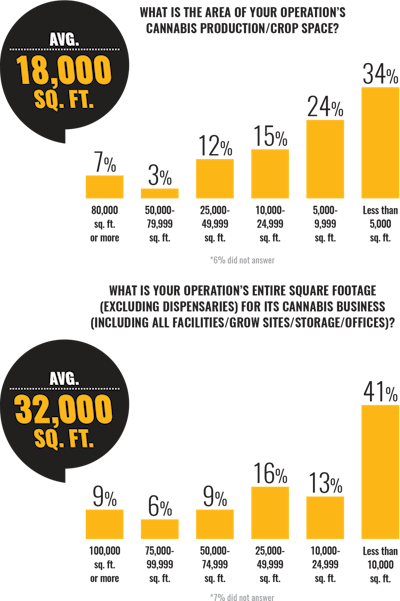

Many cultivation businesses are also fairly small — according to Cannabis Business Times’ research, 58% of cannabis businesses have a crop size of less than 10,000 square feet, with 15 employees on average. This finding likely can be attributed not only to a significant number of young businesses still in startup stages, but also to the number of small, often family-owned farms in California. Scientific American estimated that The Golden State has as many as 50,000 small cannabis farms, with 4,000 in Humboldt County alone. Many in the industry say that California actually comprises 80% of the overall cannabis market, which may be true, but we haven’t been able to verify it with the data in this report.

Just 10% of cannabis crops are 50,000 square feet or larger, and the average size of today’s cannabis farm is 18,000 square feet — less than half an acre.

Regardless of size, however, cannabis cultivation businesses are growing — and by a fairly hefty amount. Whether they are adding space to meet current market demand or in anticipation of increasing market size due to new medical and recreational markets, nearly three-fourths (71%) are planning to expand their grow operation within the next two years.

And not only that, but their expansion plans are, by and large, sizable. Twenty percent of cultivators plan to add 25,000 square feet or more to their grow space — with nearly 10% of those looking to add 80,000 square feet or more in the next two years.

_grayscale_fmt.png?auto=format%2Ccompress&fit=max&q=70&w=400)

Which of the following does your operation plan to purchase for cannabis cultivation in the next two years?

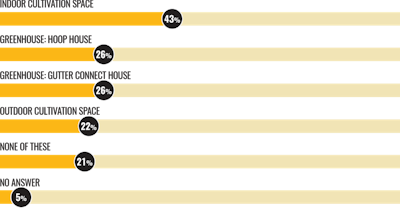

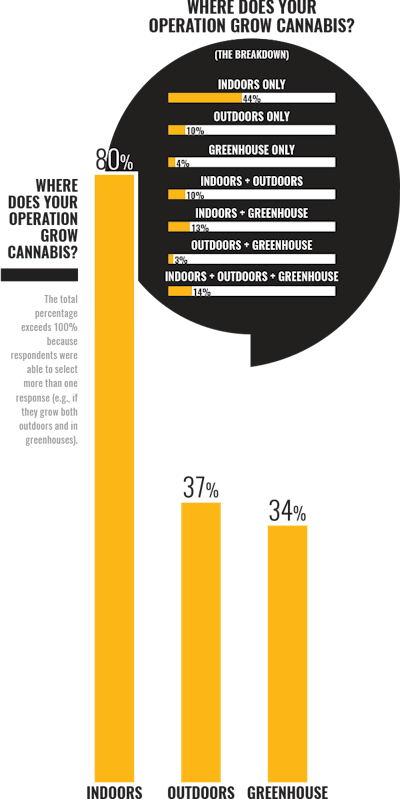

WHERE ARE YOU GROWING? (It’s not where you might think)

Common estimates in the industry suggest that outdoor grows comprise just 5% of the market today. Why such a small percentage for an agricultural crop? As many of you may already know, a lot of states and municipalities don’t allow outdoor grows. Washington, one of the top 10 most eco-friendly states (ranked by sustainability website TriplePundit), originally banned outdoor grows, but later reversed that regulation. But even within what somewhat ironically is nicknamed The Evergreen State, some counties are fighting that decision, as well as opposing greenhouse growing. As one participant in CBT’s research commented, “Mason County is outlawing outdoor and soft-sided greenhouse growing from fear of something, but I'm not sure what.”

In what will be seen as good news for many environmentally conscious growers, however, the outdoor cultivation market may be quite a bit larger than we thought. CBT’s research suggests that nearly 40% of respondents have outdoor grow components to their businesses.

Another commonly cited estimate is that about 20% of growers grow in greenhouses; but CBT’s research suggests that number is higher as well. More than a third of all cultivation businesses researched have a greenhouse as part of their grow.

Still, in a tightly regulated industry where the laws and security requirements largely dictate the prevalence of indoor cultivation sites, it’s not all-too-surprising that most growers (80%) grow at least part of their crop indoors.

When you look at those who grow exclusively indoors, however, that number is cut nearly in half (44%).

And that leads us to one of the most significant trends the research shows: cultivation in more than one type of “facility.” Forty percent of growers indicated that their cultivation is done in some combination of indoor, outdoor and greenhouse growing environments.

It may not be easy being green, but growers are trying

It’s no secret that the industry is under the public eye (and the eye of many within the industry) for its energy consumption. “In 2014, Denver’s energy demand rose from 86 million kWh annually to over 148 million kWh, primarily due to the 362 cannabis grow houses established since 2012,” wrote Kathleen Hokanson and Wil Wicke of Koan Energy Consultants in the article “20 Ways to Cut Energy Use” in the November 2015 issue of Cannabis Business Times. In that same article, the well-known report “Energy Up in Smoke: The Carbon Footprint of Indoor Cannabis Production,” by Dr. Evan Mills, was cited, stating that indoor cultivators in the United States represent 1% of all energy consumed annually. In California, that number is 3%.

Those numbers are almost unbelievable. But they are apparently not lost on cultivators. Greenhouse cultivation is on the uptick, and then some. Of the growers who don’t currently grow in a greenhouse, 41% say they will add greenhouse facilities to their grow in the next 2 years.

Also, those who grow in greenhouses plan to increase their greenhouse production space. About a quarter of growers say 75% or more of their production area is in a greenhouse today. CBT’s research shows this will jump to 35% (who will grow 75% or more in a greenhouse in the next two years).

In addition, the ability to grow multiple crop cycles year-round — without the related energy consumption incurred with 100% artificial lighting of an indoor grow — appeals to many growers.

“Greenhouses are far more environmentally appropriate because of the huge wattage to produce indoors,” commented a participant in CBT’s research. “There are some stunning figures of total electrical energy percentage used in this state [Washington] that is attributable to indoor cannabis growing. … A light-deprivation greenhouse obviates a huge chunk of that lighting need and still produces good product with 5 crops per year,” he said.

Most greenhouse growers use some supplemental, artificial light, especially in regions where sunlight wanes during certain months or is inconsistent, but supplemental lighting incurs but a fraction of the energy use and cost of an indoor grow. Greenhouse growing also is gaining popularity for its ability to diffuse sunlight, to help ensure even light distribution to all parts of the plants. Hybrid greenhouses offer insulated walls and use less supplemental light, which means being even more ‘green.’

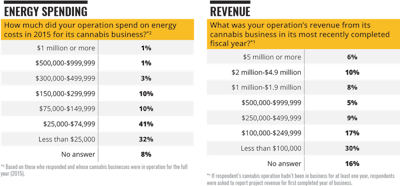

For some, the desire to curb energy use is driven by environmental concerns; for others, the concern is financial. For many, it’s both. But the bottom line is that energy consumption impacts the bottom line significantly, more than any other grow factor. The bulk of growers (41%) spent between $25,000 and $75,000 on energy in 2015, according to CBT’s research. (See the chart on p. S11.) Considering the number of smaller grows in the business, those numbers are substantial. A quarter of cultivation businesses spent more than $75,000 on energy last year, with the largest grow operations spending $1 million or more.

Is It Getting Hot in Here? Not If Technology Can Help It

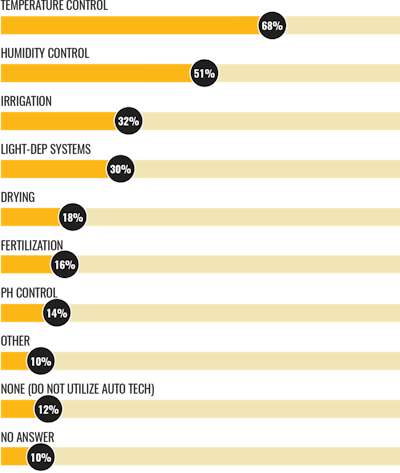

As cultivators aim to reduce cost of goods sold, a necessity in increasingly competitive markets, such as California and Washington state, automation has become key, especially when it comes to heat and humidity, both of which ranked, for many growers, among the top three factors impacting yield. More than two-thirds (68%) of cultivators report using technology to automate temperature control, whether for indoor or greenhouse cultivation. More than half utilize humidity-control technology.

For which systems does your operation utilize automation technology in its cannabis cultivation?*

Organic Cannabis: Practicing What You Preach

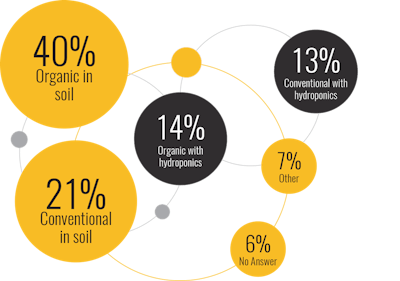

If we’ve heard it once, we’ve heard it a million times: Growing organic cannabis is the only way to grow. Of course, it’s technically not, but anecdotally, it’s been a common theme among many successful cultivators. CBT’s research shows that growers are, in fact, making organic growing a priority. More than half (54%) of cultivators say they grow either organically in soil or organically with hydroponics.

While cannabis remains federally illegal, it can’t be “certified organic,” but growers are obviously not deterred, believing that organic cultivation not only impacts product quality, but also product safety and consumer purchasing decisions.

While organic cultivation isn’t entirely based on pesticide use, or the lack thereof, for consumers, an “organic” or equivalent label (a couple similar certifications have popped up in the industry) may just put their minds at ease, considering the any-number-is-too-many pesticide-related product recalls, most notably in Denver. (That is not to suggest that Denver growers are more inclined to use illegal pesticides, but rather the city’s attention to the matter.) And many growers place a high priority on being able to, at least in concept, if not officially, call their crops “organic,” refusing to put anything that might be harmful on their plants.

Green Rush? Not So Much

Another trend prevalent in the grower market is the consensus that the perception of the “green rush,” where you simply invest in a cannabis business, plop in some plants and start raking in the dough, is just not reality. It’s more a business of blood, sweat and tears … or nutrients, sweat and fears (compliance).

The costs to set up a full-scale cannabis operation are significant (often millions of dollars). The challenges abound (compliance, banking, security/safety and theft, pests, staffing, etc.). And competition is stiff, especially in markets such as Washington state, where supply outpaces demand. Oh, and there’s that teensy-weensy little thing called the Federal Government, which still considers cannabis illegal as a Schedule I drug. Not to mention the knowledge and skill required to maintain a successful cultivation operation.

According to CBT’s research, almost half of cultivators generated less than $250,000 in their most recently completed fiscal year. A green rush? Possibly not so much (depending on their costs of goods sold, of course).

On the flip side, nearly a quarter (24%) of growers report making $1 million or more in the past fiscal year.

An Industry Poised for more growth

This year is going to be a pivotal one for the industry, with:

- a measure to legalize and regulate marijuana like alcohol on the ballot in Nevada,

- two states (Arizona and Michigan) currently collecting signatures to get on this year’s ballot,

- ballot initiatives underway in California and Massachusetts, the latter of which also has a legislature-driven bill on the table, as does Vermont, and

- other states, such as Ohio and New Jersey, working on legalization efforts — Ohio through a second try at passing a ballot measure, and New Jersey through the state legislature (more on that to come soon).

While many thought Maine was a shoo-in for legalization, one initiative in the state failed in mid-March to collect the number of qualifying signatures it needed to get its measure on the 2016 ballot (though, at press time, backers of the initiative had filed a lawsuit saying the disqualification of 17,000 signatures should be reversed). Some remain optimistic the state still will be among those moving to end prohibition this year, as other initiatives are in the works as well. Medical programs also are expanding.

If even a handful of states pass legalization efforts this year, the growth in the already-growing market will be significant. Many cultivators are watching closely, with new launches or cross-state expansion plans at the ready.

As more states legalize cannabis, growers have a greater chance than ever to make an impact in the industry.

Note: Data in this report is based on research conducted during January and February 2016 of 100 cannabis cultivators based in 17 states.