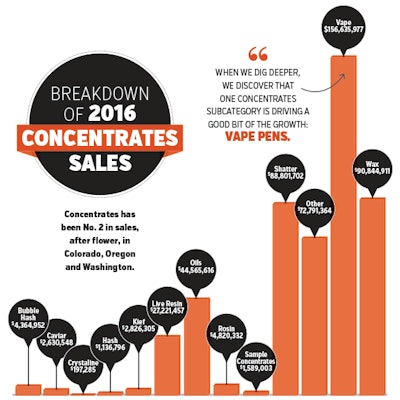

All categories of cannabis sales are growing, but concentrates has been the No. 2 area of cannabis sales, after flower, since the launch of recreational cannabis in Colorado, Washington and Oregon. Yet the giant category still managed to grow by 83.9 percent during 2016 between the three states, with sales of $498.4 million.

Only one large category last year surpassed concentrates in terms of growth: pre-rolled joints, with sales up 149.2 percent in 2016 over 2015. But pre-rolled joints represent a much smaller market ($158 million last year), with far fewer barriers to marketplace entry than concentrates.

Every year, the concentrates category chips away at market share. It accounted for 21 percent of the overall cannabis market during 2016, up from 18 percent in 2015, for example.

When we dig deeper, we discover that one concentrates subcategory is driving a good bit of the growth: vape pens, sold as kits (purchase includes a pen with an oil-filled cartridge that can be replaced), as replacement cartridges for pens, and as disposable pens.

During 2016, vape pens accounted for 31 percent of concentrate sales between Colorado, Washington and Oregon, and hauled in $157 million in sales in those states last year, representing growth of 127.6 percent. Meanwhile, growth of the other big concentrates subcategories, wax and shatter, grew by 81.7 percent and 65.3 percent, respectively.

And growth in 2017 continues. During Q1 2017 in Colorado, vape grabbed 30 percent of market share in concentrates (up from 27 percent for 2016), representing growth of 90 percent over the same quarter last year.

In Washington, during January and February of this year, vape sales represented 32 percent of the concentrates market, with growth rates of 62.9 percent.

Oregonians are especially fond of vape pens; in the Beaver State, vape sales during Q1 2017 represented 61 percent of concentrates sales. Since recreational dispensaries in Oregon could not sell vapes until June of last year, year-over-year sales comparisons are not available. But market share is telling, and in Oregon vapes are taking off.

The concentrates market is an interesting one, bifurcated between dedicated cannabis users who use elaborate dab kits to vaporize products like shatter and wax, and people who love the no-fuss, discrete convenience of vape pens, which easily fit into a pocket or purse, vaporize concentrates with the push of a button, and broadcast little in terms of odor or vapor clouds.

Regardless of the product, the overall market is a particularly vibrant one. And with new states launching recreational regulatory regimes in coming months, the buzz for concentrates is unlikely to turn into a buzz kill anytime soon.