The U.S. hemp-derived cannabidiol (CBD) market is expected to reach $23.7 billion by 2023, up from the current value of $5 billion, according to CBD and cannabis research firm Brightfield Group. Thousands of farmers are ramping up production following passage of the 2018 Farm Bill, which legalized hemp at the federal level, as state industrial hemp programs expand.

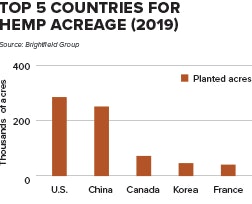

The U.S., China and Canada lead global industrial hemp cultivation in 2019 in the number of acres planted, according to Brightfield Group’s recent “Hemp Cultivation Landscape” report. Farmers planted an estimated 288,000 acres of industrial hemp in the U.S. in 2019, up from 78,000 acres in 2018, according to the report.

In the U.S., the profit potential of CBD is driving the growth in hemp cultivation, with about 87% of the 288,000 acres expected to be used for CBD processing in 2019. On a per-acre level, hemp for CBD could potentially generate $45,203 in revenue, compared with $773 for corn.

Flexibility and a high risk tolerance are important in hemp farming, as multiple challenges exist when growing hemp for CBD extraction. These include:- Difficulty obtaining certified feminized seeds and clones. Farmers looking for the highest revenue potential desire female hemp plants because CBD levels are highest in unpollinated female plants. Planting female clones ensures all female hemp plants, but the high cost and limited availability has restricted its use. With the shortage of certified feminized hemp seeds, farmers have purchased so-called feminized seeds without guarantees that they will be male-free or high in CBD.

- Labor-intensive growing. Hemp cultivation requires a lot of manual labor, especially during harvesting. Because the U.S. industrial hemp industry is new, options for hemp harvesting machinery are limited, so some farms are retrofitting their machinery to harvest hemp for floral material, where the CBD content is highest in the hemp plant.

- Required expertise. Growing hemp for CBD extraction is not a row crop like corn and soybeans. Cultivating hemp for CBD is similar to vegetables and requires more space between plants.

- Lack of traditional markets for selling hemp. The result is less price transparency and companies not honoring agreements to buy hemp from farmers.

- Risk of a “hot crop.” Industrial hemp crops can fail state agricultural department testing prior to harvest if test results show more than 0.3% tetrahydrocannabinol (THC) by dry weight. The farmer is then required to destroy the crop.

- Pollen drift issues and cross-pollination risks. CBD levels are highest in unpollinated female hemp flowers, while male hemp plants produce no flower. If male hemp plants, which are grown for fiber and grain, are planted too closely to female plants being grown for CBD, the male plant can pollinate the female plants and lead to lower CBD yields as the plant expends energy for seed production rather than floral production. Similarly, the presence of male hemp plants can reduce the THC content of the female cannabis plant if pollination occurs.

Despite the risks involved with the industry, more U.S. farmers are expected to invest in hemp cultivation. American farmers can capitalize on the rising demand for U.S.-grown hemp by marketing their CBD brands as “grown in the USA” or “locally sourced.”