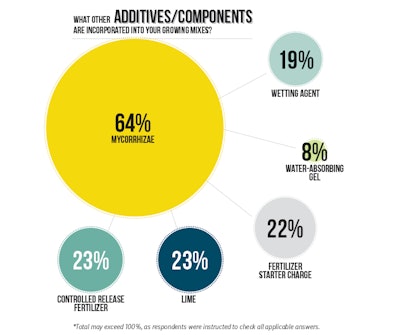

Media Additives

Analysis

Mycorrhizae seems to be a very important additive for cultivators, as nearly two-thirds (64%) indicate they incorporate it into their growing media. Other top additives-although all used by less than one-quarter of respondents-include lime, fertilizer starter charge and controlled release fertilizer. Nineteen percent utilize wetting agents, and 8% use water-absorbing gels.

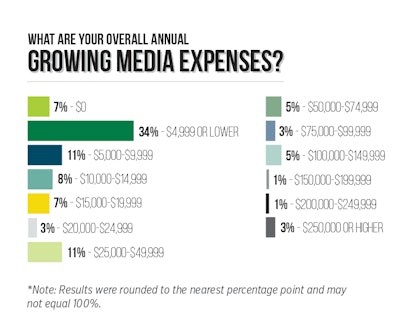

Spending

Analysis

What cultivators pay for their growing media is just as diverse as the types of media they utilize in their facilities. Seven percent say they don’t spend anything on growing media annually-perhaps some of those respondents rely on field soil, and others indicated they grow aeroponically (without any media). Just over one-third of cultivators spend a bit more ($4,999 or less). Growers who spend between $10,000 to $19,999 total 15% of respondents; and 10% of respondents shell out more than $100,000 annually on their growing media.

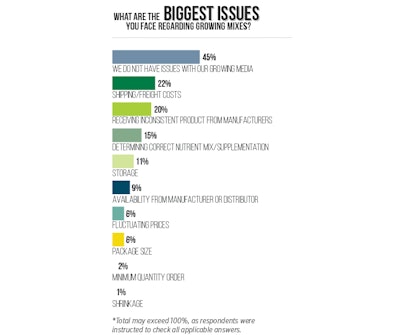

Media Challenges

Analysis

The three top growing media challenges among research participants include: shipping/freight costs (22%), receiving inconsistent product from manufacturers (20%), and determining correct nutrient mix/supplementation (15%).

Growing Media Quick Tips

Survey participants shared quick tips about how to best optimize your media’s use.

“Store data, keep track of every detail.”

– Tim Schimmel, Kind Farms“Make sure not to overfertilize, which leads to nutrient lockout.”

– Scott Holland, Willow Industries (formerly Durango Organics)“Get to know your manufacturer and the processes they used.”

– Preferred to remain anonymous“Educate yourself on how to control your medium’s air/water ratio and prevent salt build-up.”

– Cody Fasbinder, Urban Greenhouse“Manage media pH/EC levels through testing and manipulating feeding schedules.”

– Preferred to remain anonymous“Dialing in the correct amount of time that soaks the grow media to maximize the time between feedings is key.

– Jerome Jabson, Natural Green ReLeaf