The previous three Biology Brief columns covered the most common extraction technologies used in the cannabis industry and their strengths, weaknesses, laboratory requirements and scaling considerations. Here, we’ll explore another equally important avenue of the cannabis oil manufacturing industry: an estimation of revenue generation and break-even points for capital expenditures and running expenditures in an appropriately scaled laboratory.

Please note that this is a simplified example of a business model that does not account for all business expenditures. It is intended as a primer for realizing costs and estimating revenue from an oil manufacturing endeavor.

For this example, we will use a supercritical CO2 extraction laboratory.

The development of any laboratory model requires that certain assumptions are made. Our hypothetical laboratory’s model is no different. Let’s identify the front-end production assumptions that will drive the downstream manufacturing infrastructure and revenue generation:

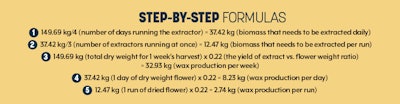

First, let’s say that the laboratory we are constructing will need to process 2,200 greenhouse-grown plants for extraction every week. Also, we’ll assume that each plant has an estimated wet weight of 907.2 grams (i.e., 2 lbs.), an estimated flower-to-stalk ratio of 0.30 (meaning flowers make up 30 percent of the plant’s wet weight), and an estimated drying ratio of 0.25 (meaning the dry weight of the plant is 25 percent of its wet weight). With those assumptions, the total weekly production of the grow is 149.69 kg.

Extraction

Next, we need to identify assumptions for the extraction equipment that will be capable of handling the front-end production in the time available between crop batches. Our hypothetical laboratory will be designed to extract all 149.69 kg in a four-day period to allow for cleaning the extraction facility on the fifth day.

The reason for the production gaps is because one assumption of our laboratory is that it will be Good Manufacturing Practice (GMP)-certified, which requires certain levels of cleanliness and sanitation. To meet the demand imposed by the dry flower production, each extractor run must consume 12.47 kg, or a total daily plant material consumption of 37.42 kg if three extractions are conducted daily. (We will assume that three extractions is what is done in this model.) Furthermore, the extractor is expected to operate at a 95-percent cannabinoid extraction efficiency, and yield 22 percent by mass. The resulting crude-wax production is estimated to be 2.74 kg per run, 8.23 kg per day and 32.93 kg per week.

Refinement

For simplicity, one week’s worth of extractions will be considered a batch in this laboratory framework. And, again, the refinement process has also been designed to take four days to allow for one day of equipment cleaning and sanitation. The refinement process, like the extraction process, will also follow GMP guidelines. The process will incorporate the system’s 316 stainless steel vessels and require minimal human intervention.

The 32.93 kg of weekly crude wax material will be retained in a jacketed reaction vessel (~200 liters (L)), where the dissolution and winterization processes will be controlled. The estimated amount of ethanol used during the dissolution process is 131.73 L to filter 164.66 L of total volume material. The inline filtration system will remove solids (estimated in this model at 15 percent of total crude mass, or 4.94 kg) and clarify the oils.

The resultant ethanolic cannabinoid mixture volume, after washing the media, is 329.32 L. The reason the volume doubles (again, a projection) is that it is necessary to wash the waxes to ensure that there are no cannabinoids entrained in the material. That volume will be held in the 316 stainless steel vessel (~400 L) to await solvent (ethanol) recovery.

A direct-feed, industrial-scale solvent recovery system capable of 32 L/hour throughput is required to remove the estimated 296.39 L of recoverable ethanol in a single work day. That system must yield a final product with 0.5 percent or less residual ethanol (Food and Drug Administration pharmaceutical manufacturing limits) in a single pass to meet our production timeline.

Finally, this process will yield 27.43 kg of refined, full-spectrum oil per week, after accounting for the wax removal and 2-percent transfer losses.

Product Offerings

The next set of assumptions are for our product offerings. Let’s say our laboratory is going to be a bulk supplier of full-spectrum oils (80-percent purity) and distillate (95-percent purity). Secondly, this manufacturing laboratory will offer 60 percent and 40 percent of its total production as bulk full-spectrum and distillate, respectively. Therefore, a total of 16.46 kg of full-spectrum oils and 8.78 kg of distillate (after accounting for 0.80 distillation recovery ratio) will be offered weekly for sale.

Capital Costs

Now for some estimations of capital costs that would be associated with a facility of this size. Let’s estimate the cost of the grow infrastructure (greenhouses with lights) and building capable of housing all the required manufacturing infrastructure at roughly $8 million. The plant-drying infrastructure (which would be required to capture 449.06 kg of water per week) and grinding equipment are estimated at $75,000. The extraction equipment is estimated at $650,000. Additionally, reactors, filters, temperature control and holding vessels are assumed to cost $135,000. The solvent recovery system and cannabinoid distillation system are estimated to cost about $305,000. Finally, a buffer of $75,000 is incorporated to account for ancillary items. The grand total of capital expenditures for our hypothetical GMP certifiable manufacturing business is $9.24 million.

Running Costs

Running costs are another component of the business that must be accounted for to increase the resolution of the model. For this portion of estimations, let’s exclude all support staff that would be included in a business (i.e., C-suite, administrative, etc.). Insurance or distribution costs are also not included here. From a purely manufacturing standpoint, our cannabis oil manufacturing business will employ a grow manager, six grow technicians, a laboratory director and four laboratory technicians. The laboratory director and grow manager have estimated salaries of $100,000/year, while the laboratory technicians and grow technicians have estimated salaries of $45,000/year and $40,000/year, respectively. With that information, the total yearly salary overhead is estimated to be $620,000/year or $11,923.08/week.

Let’s also estimate the costs of growing a single plant from clone to maturity at $12.50 (including all pots/nutrients). The total estimated plant costs expenditure per year would therefore be $1,237,500/year or $23,798.08/week (based on 45 grow cycles over 52 weeks).

To refine oils into final product for distribution, the assumed/estimated total weekly costs of carbon dioxide, ethanol and clarifiers, is $135/week ($7,020/year), $148.19/week ($7,705.94/year) and $246.99/week ($12,843.23/year), respectively. Finally, let’s estimate the total cost of electricity for our cannabis oil manufacturing facility at $350,000/year or $6,730/week (this is a high-end estimate).

The sum of running costs for our hypothetical cannabis oil manufacturing facility with these assumptions would be $2,235,069.17/year or $42,982.10/week.

Product Sale Price

As previously mentioned, our cannabis oil manufacturing business will focus on two central products: bulk sales of full-spectrum oil and distillate. To further develop the model, it is necessary to estimate the sale price of each of those products. We will use the sale prices of $8/gram and $12/gram of full- spectrum and distilled oils, respectively.

Recall that our laboratory is assumed to produce 16.46 kg of full-spectrum oil and 8.78 kg of distillate oil per week. Using the estimated sale prices and our weekly production estimates, the estimated weekly revenue for our hypothetical cannabis oil manufacturing business is $237,010.95 ($131,672.75 attributable to full-spectrum oils and $105,338.20 attributable to distillate). From this, we can deduce that our first week of sales has not even dented our capital expenditures nor capital expenditures plus running costs. Extending our model to determine break-even points for capital expenditure and capital expenditure plus running costs suggests that our laboratory will recoup our capital expenditures around week 39 and nearly meet the capital expenditure plus running costs at week 48.

Finally, at the one-year point (52 weeks) our manufacturing facility is expected to net $849,500.23 based on this model.

Wrapping Up

This is a theoretical business model that incorporates most variables that will be encountered running an extraction business. It was nearly impossible to account for all the variables necessary to fully flesh out a comprehensive model. Despite this, take into account the importance of attempting to estimate the break-even points for a fully scaled, comprehensive manufacturing business where front-end production is balanced with back-end processing.

In general, the costs associated with the construction of all types of extraction facilities are quite similar—because where you might save money selecting one extraction technology over another, the savings will likely be spent in another portion of the build-out (i.e., solvent recovery, Class 1 Division 1 build-out, etc.). Therefore, the allocation of capital expenditures among categories will vary based on the solvent used in extraction.

Attempting to understand the costs associated with setting up and running a laboratory is extremely important to the success of any business because the business owner can estimate how much free running capital he or she should have on hand, how much time it will take to provide a return on investment to investors and how to best deploy capital.

2.png?auto=format%2Ccompress&fit=crop&h=141&q=70&w=250)