This past year has been a mixed-bag for the cannabis cultivation industry. The new federal administration has raised many questions regarding the government’s stance and intended actions toward legalized marijuana. The president’s appointment of Attorney General Jeff Sessions particularly caused blood pressures to rise. Sessions—a well-known prohibitionist—commented during a mid-March appearance before local, state and federal law enforcement officials in Richmond, Va., “I am astonished to hear people suggest that we can solve our heroin crisis by legalizing marijuana—so people can trade one life-wrecking dependency for another that’s only slightly less awful.” During that same appearance, however, Sessions said that much of the Obama-era guidance that has enabled states to legalize, regulate and tax marijuana is “valid,” providing some hope that any feared Federal interference in the industry may not materialize.

Despite new levels of uncertainty, many cultivators have remained only slightly concerned or unshaken. In this year’s “State of the Industry” report, Cannabis Business Times asked cultivators and/or cultivation business owners, “How much is the uncertainty about the federal government’s potential policies regarding legalized marijuana at the state level affecting your current or future business plans?” The largest percentage (41%) said “somewhat,” while more than a third (35%) said “not at all.” Just under a quarter (23%) indicated that this uncertainty is “very much” affecting their current or future business plans.

The confidence many indicated could be a reflection of the major progress that continues to be made in the fight to end prohibition, as well as the impact the legal cannabis industry continues to have on state and local economies. With eight U.S. states now legalizing adult-use marijuana—including two on the East Coast—and over half the country (and growing) legalizing some form of medical marijuana, the industry continues its rapid growth trajectory. Canada’s medical marijuana program continues to expand as well, now serving more than 130,000 patients, and full legalization looms on the country’s horizon.

Marijuana sales in North America reached $6.73 billion in 2016—reflecting 34% growth over 2015 ($5.04 billion), according to Arcview Market Research/BDS Analytics. The research firm projects sales to jump to $21.6 billion by 2021, representing a 26% compound annual growth rate (CAGR).

Another market research firm, New Frontier Data, estimates 2016 marijuana sales at $7.2 billion and forecasts the market to reach $24 billion by 2025, reflecting a 15% CAGR.

The cannabis industry continues to exceed other industries’ growth rates and retain the title of the “fastest-growing industry in the U.S.” as the Huffington Post reported in 2015. For example, the fast-growing U.S. organic industry reached a new high of $43.3 billion in 2015, reflecting 11% growth over the previous year, according to the Organic Trade Association. The U.S. video game industry is projected to grow by a 3.6% CAGR to reach $20.3 billion in 2020, according to a report by PwC.

States and municipalities continue to reap the benefits of marijuana legalization. Overall state tax revenue generated from retail marijuana sales is projected to reach $2.3 billion by 2020, according to New Frontier Data.

GROWTH PLANS

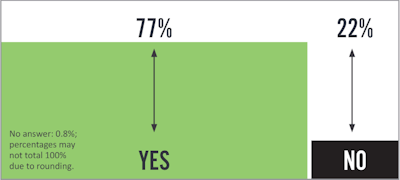

Do you plan to add square footage to your operation in the next two years?

Job creation, which has largely remained untracked, is starting to be examined. Economic and management consulting group Whitney Economics recently found that in Oregon alone, 12,500 jobs have been created in the cannabis industry, generating $315 million in salaries averaging over $12/hour.

The State of the Cannabis Cultivation Market

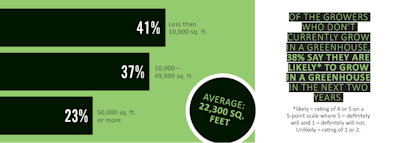

Obviously, the roots (pun intended) of the entire cannabis cultivation market continue to grow as well. According to the Cannabis Business Times’ research, 77% of cultivators plan to add square footage to their existing operations in the next two years—an average of 22,300 square feet at that.

While cultivators in some regions, most notably Washington state—where supply continues to outweigh demand—struggle to maintain, not to mention grow their businesses, growth is on the horizon for this industry segment as a whole, as medical markets continue to expand and legalization continues to spread across the country.

This special report—made possible thanks to the generous support of Nexus Greenhouse Systems and conducted by independent research firm Readex Research—delves into that growth and provides benchmarks to help you see how your business compares to the overall industry, whether in terms of revenue generated, pounds of flower produced, square footage of your cultivation space, growing methods or even your biggest challenges. So, without further ado, Cannabis Business Times is pleased to present its “State of the Industry” report with findings from this important research project.

ADDING SPACE

If your operation plans to add square footage for growing in the next two years, how much does it plan to add?

Expansion Plans: Indoor, Greenhouse or Outdoor?

Considering more than three-fourths of existing cannabis cultivation business plan to add square footage in the next two years, it’s noteworthy to evaluate what type of space they’re planning. Of those who indicated they plan to add cultivation space, it was an even split between cultivators who are planning to add indoor warehouse space (56%) and those who are planning to add greenhouse space (56%). Nearly 25% said they intend to add outdoor cultivation space. (Respondents were able to select more than one option—if they intend to add both warehouse and greenhouse space, for example—so totals exceed 100%.)

Among cultivators planning to add greenhouse space, it also was a relatively even split between those who plan to add gutter connect houses (53%) and those who plan to add hoop houses (57%).

Where Does Your Garden Grow?

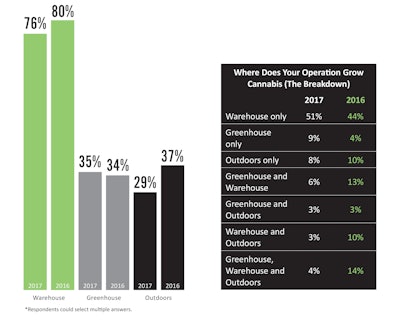

Depending on who you talk to, the future of cannabis cultivation—as an agricultural crop—is either in greenhouses or outdoor cultivation. However, with many states mandating indoor cultivation, whether due to social stigma, perceived security risks or a variety of other reasons, it’s not all that surprising that the majority of cannabis cultivation currently is done indoors. More than three-fourths of cultivators who participated in the research said that they grow indoors/in a warehouse.

AT A GLANCE

Where does your operation grow cannabis?*

That number, however, was a slight decrease from last year’s data, which showed that 80% of cultivators were growing indoors.

Outdoor cultivation also dropped 8 percentage points compared to last year. Greenhouse cultivation was the only segment to increase this year, though by a very slim margin of 1 percentage point.

ABOUT THE RESEARCH

The research for the “State of the Industry” report was conducted by independent research organization Readex Research, during January and February 2017. Results are based on a total of 237 research participants from North America.

The margin of error for percentages based on 237 respondents who currently own or work for an operation that grows cannabis is ±6.2 percentage points at the 95% confidence level.