The cannabis beverage market is growing 15% year over year, according to a recent BDS Analytics report for 2019, but a closer look reveals an important story about where dispensary retail trends are taking us. Within the overall cannabis beverage market, sales of low-dose THC beverages, like Two Roots Brewing Co.’s line of cannabis-infused non-alcoholic beers, are growing 70% year over year, according to BDS.

All told, cannabis beverages comprise approximately 6% of all legal ingestibles sales (a category that includes all edibles, tinctures, capsules, etc.), according to BDS, but the foundation for a new way of looking at how cannabis consumers use these products is emerging—and fast.

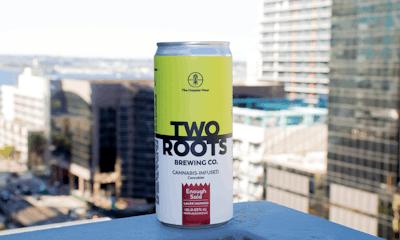

Cannabiniers is a good example. The company distributes its flagship line of non-alcoholic cannabis beers under the Two Roots brand in Nevada and California—with more markets in its executives’ sightlines. Michael Hayford, CEO of Lighthouse Strategies (parent company of Cannabiniers), points to a gold medal from the recent 2019 Great American Beer Festival as evidence of his company’s success in the cannabis-infused beer market.

So, what does it take for a cannabis beverage company to make some noise in this competitive industry?

“We had an adviser about a decade ago who kind of drilled into our brains that entrepreneurs need to be really self-aware about what they don’t know,” Hayford says.

In 2016, Hayford and his team began researching the technology that would allow them to create Two Roots—a cannabis-infused, non-alcoholic beer. By March 2018, they were up and running. But in the intervening two years, Hayford had some homework to do.

“In that time frame, what did we have to figure out?” he reflects. “‘Where can I put this technology? What is the regulatory structure? Do I need special permitting?’”

It turns out that craft brewers have been confronting those questions head-on for decades. They know what Hayford didn’t know—and so he went to them. “If I’m going to make a great non-alcoholic beer, I need to start with a great alcoholic beer,” he says. “I need a really great brewer.” In October 2017, Cannabiniers acquired Helm’s Brewery in San Diego. The space was big enough to get them started with a 50,000-barrel annual capacity. (Cannabiniers rebranded Helm’s as Two Roots Brewing Co. in early 2019.)The company’s goal is to own 500,000 barrels of brewing capacity in the next few years. “A lot of people have told me that my forecasting is really aggressive,” Hayford says with a laugh.

Because of the U.S. cannabis market's fragmented nature, the strategy for companies like Cannabiniers has been one of incremental growth and brand-forward marketing might. Essentially, this cannabis company is becoming a microbrewery platform. It’s not a model that would be possible without a clear acquisition strategy.

In September, the company announced plans to acquire Auburn Hills, Mich.-based Rochester Mills Brewing Co. This deal follows the acquisition of Dad & Dudes Breweria in Aurora, Colo., a business that’s made a regional name for its CBD-infused beers. Both moves are part of a longer process of replicating early success on a broad scale across the U.S.—moving into new spaces while deepening a presence in Nevada and California.

“The real focus is: What are you going to do with that infrastructure?” Hayford says. “Flower prices aren’t going up. The value of dispensaries is not going up. You have this infrastructure; what are you going to do with it? [Seeing] the trends going forward, I think brands are going to be important.”