Cannabis stocks quickly rallied after President Joe Biden’s surprise announcement on Oct. 6 that the federal government will pardon simple cannabis possession offenses and that Attorney General Merrick Garland and Secretary of Health and Human Services Xavier Becerra will review cannabis’s current status as a Schedule I drug in the Controlled Substances Act.

The move sent shockwaves through the industry, which largely welcomed the news, hailing it as a “step in the right direction” amidst a difficult year of falling prices, increasing competition, and unwavering state and federal legal restrictions.

Please see our statement about today’s news from the Biden Administration. $CCHW $CCHWF #ColumbiaCare pic.twitter.com/vFy3645zab

— Columbia Care (@ColumbiaCare) October 6, 2022

Above: Multistate operator Columbia Care’s statement via Twitter in response to Biden’s announcement on Oct. 6.

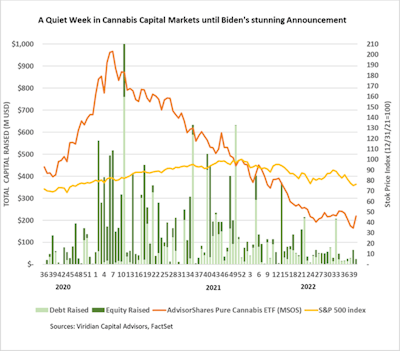

Although cannabis stocks are still trading well below their peak pandemic-era levels in 2020, “this rally, percentage-wise, was biggest in the year,” said Frank Colombo, director of data analytics for Viridian Capital Advisors. In fact, the 32.4% gain measured by Advisorshares Pure Cannabis ETF (MSOS) was the “largest one-week gain since the ETF began in September 2020,” according to the Viridian’s Deal Tracker.

“The fact that President Biden did follow through with that messaging and with the direction to the agencies to really get moving on this, I think sent a strong statement and [provided] confidence in the market to investors and all stakeholders that the government was taking this seriously,” Curaleaf CEO Matt Darin told Cannabis Business Times.

The lack of movement from the federal government over the years, even as most states in the nation have passed some form of cannabis legalization, has created significant financial hurdles for the industry, such as the prohibition of interstate commerce; restrictions on banking and access to capital; as well as the pressures of IRS Tax Code 280E, which prevents cannabis companies from deducting operating expenses and significantly cuts into profitability.

Not to mention, American plant-touching cannabis companies are not permitted to up-list on larger U.S. exchanges like the Nasdaq and the New York Stock Exchange (NYSE) due to those exchanges’ policies concerning the country’s federal illegality of cannabis.

“Just like any bank, it’s not illegal for a bank to work with a cannabis company, and some do… but most don’t. It’s very complex, and if they make a mistake, they could get in big trouble,” New Cannabis Ventures Founding Partner Alan Brochstein told CBT.

Instead, these U.S. companies typically trade on Canadian exchanges such as the Canadian Securities Exchange (CSE).

Perhaps ironically, because cannabis is federally legal up north, Canadian companies such as Canopy Growth, Tilray, Aphria, and others do trade on these U.S. exchanges, which provides a significant edge from an investor-access standpoint.

However, “the U.S. [multistate operators] have better balance sheets, and I think at the end of the day, investors trust them more,” Brochstein said.

And yet the hurdles of the status quo are very much in play for those U.S.-based businesses interested in competing on public markets domestically.

“We try to have the best business we can, but we kind of run that business with one hand tied behind our back and our feet tied together,” said Jennifer Drake, co-chief operating officer of multistate operator Ayr Wellness, in an interview with CBT. “If you’re valuing a company, and you see the levels of kind of profitability that people have today based on this current constrained model, and then [wonder], ‘Well, what would it be like if you removed those constraints?’ I think that gets people really excited about the stock prices.”

The Oct. 6 stock rally, while encouraging, didn’t last long.

“Over the course of the next two weeks, ‘til right now, we’ve lost basically two-thirds of that,” Colombo said, adding that people quickly came to the realization that the announcement, “is not tomorrow’s news.” Cannabis stocks finished that week 54% lower year-to-date, according to Viridian.

However, after CBT spoke with Colombo, cannabis stocks received a bit of a boost at the end of the month, after U.S. Sen. Chuck Schumer (D-NY), shared in a debate with his Republican opponent Joe Pinion on Oct. 30 that he has been in talks with Republicans about enhanced versions of the SAFE Banking Act, and that Congress is "very close" to its passage, which was first reported by Marijuana Moment on Oct. 31 (more on this below). MSOS, for example, closed on Monday with a 7.27% gain.

Whether they can regain that lost momentum and continue upward largely depends on what happens next.

Does Rescheduling or Descheduling Cannabis Move the Needle?

Rescheduling cannabis to Schedule III or lower, or completely descheduling altogether, would remove the tax burden of IRS Code 280E and provide major financial relief to all cannabis companies operating in state-legal markets. Such a move could also provide a bump to cannabis stocks, as positive reform announcements tend to do. It could also pave U.S. plant-touching companies a pathway to U.S. exchanges.

“It’s not written in stone, but if we were to reschedule or deschedule (even more so), it would probably lead the New York Stock Exchange and Nasdaq to review their anti-cannabis [stances],” Brochstein said.

That could give a huge advantage to U.S. companies looking to up-list.

Publicly traded U.S. cannabis companies are “dying to be Nasdaq-listed and for good reasons,” Colombo said. “Because if you look at the trading volume of the biggest MSOs, of Curaleaf and GTI and Trulieve … against the trading volume of … Canadian companies Tilray and Canopy Growth and Aurora, these are companies that are losing money hand over fist. But they still have humongous trading volume compared to our companies. … That liquidity is part of the reason. It’s two things: It’s institutional investors, and it’s liquidity, and those two are totally tied together. Why are there no institutional investors? Because there’s not enough liquidity. Why is there no liquidity? Because there’s no institutional investors. So those two go hand in hand. And they all tie to major indices listing.”

This financial Catch-22 plays out in the strategic planning intentions of many U.S.-based multistate operators. In the absence of institutional investors and meaningful liquidity, operators, like Ayr Wellness, for instance, confront compounding challenges in raising capital against their business valuations.

“If you look at the differences in multiples between Canadian plant-touching businesses that trade on the Nasdaq or NYSE, and U.S. plant-touching businesses that don’t, there’s a huge difference in valuation,” Drake said. “And that means the cost of capital is much lower for the Canadians than it for the U.S. So, if our cost of capital goes down a lot—which means our stock prices would go up a lot—that would be great for current holders of the stock, and would be good for the potential prospects for the people who want to get access to those capital markets at a more reasonable price.”

Relatedly, on Oct. 25, Canopy Growth announced plans to enter the U.S. market through a new holding company, Canopy USA, and formalize its planned acquisitions of U.S.-based cannabis companies Acreage Holdings, Jetty Extracts and Wana Brands ahead of federal legalization. The Nasdaq, however, objected to Canopy consolidating the financial results of Canopy USA in the event of those transactions, according to a Securities and Exchange Commission (SEC) filing by Canopy.

RELATED: Canopy Growth Faces Possible Delisting From Nasdaq Upon US Entrance

Public Markets Prospects Still Ride on SAFE Banking

Another way the NYSE or Nasdaq could consider opening to U.S. companies is if the Secure and Fair Enforcement (SAFE) Banking Act passes in Congress, experts noted.

The SAFE Act “would prohibit federal regulators from taking punitive measures against financial institutions that do business with state-legal cannabis operators,” CBT reported. It’s possible a form of the SAFE Act now being called “SAFE-plus,” which includes social equity provisions, could pass during the lame-duck session of Congress after seeing some momentum from Biden’s announcement.

“It's so absolutely critical that SAFE Banking does get passed because it's going to really, I think, help fix a lot of the capital markets and plumbing issues,” Darin said. “It's also going to provide access to capital, help [the] community [that] is disproportionately impacted by the war on drugs. So, it's going to help companies small, medium, and large.”

So, what specifically could the SAFE Act to do help cannabis stocks?

It would be more of an indirect benefit.

“One of the issues is custodial services of stocks,” Colombo said. “When you have a stock in your Fidelity account, there’s some bank that’s holding all those shares in custody for the investors, called custodial services. And one of the things that’s totally lacking in cannabis is … nobody wants to hold these stocks in custody for investors to be able to trade.”

To explain custodians, or custodial services, Drake provided an illustrative analogy.

“Custodians are almost like parking lots for securities,” she said. “That’s where you keep your car, you keep your securities. And the federal government doesn’t necessarily mind if you park your car, but the activity of getting the car, and giving you the keys, and paying for the parking … sort of the stuff the attendant does, it’s not clear that it’s legal.”

Here, Drake is comparing that activity to things like transactions for deposit accounts, where banks may need to do some extra due diligence to determine if the funds coming in are being generated legally to avoid potential anti-money laundering penalties.

While some institutions are willing to take on that risk, others aren’t, Drake said.

Colombo said the importance of the SAFE Act for publicly traded operators is that it could get banks more involved in the servicing side of cannabis over time—especially as it relates to regular deposit accounts. “I think over time that will loosen them up to be more willing, even without deregulation or descheduling. … It will embolden the exchanges to increase custodial services. Once that happens, you’ll get more willingness of institutional investors to come in,” he said.

Regardless, even if Nasdaq or NYSE open up to U.S. cannabis companies, Drake said explicit safe harbor language for these exchanges from the federal government is needed, which she so far hasn’t seen.

“If there were a safe harbor, and the companies currently listed on the Canadians Securities Exchange somehow have access to U.S. exchanges, then that would open up a huge new buyer base to U.S. plant-touching cannabis businesses,” Drake said.

When it comes to exchanges like the Nasdaq, “They’re not going to stick their necks out for no reason,” Colombo added. “But if a bunch of big institutional investors come in and say, ‘We want you to list these companies because we’re interested in investing in them, and the banks are willing to go along with holding these shares,’ I think you will get the up-listing.”

Colombo also predicted that if a major federal move happens, stocks may not perform as well as they did in 2020—largely because market headwinds plaguing the industry still exist—but U.S. operators may be able to begin tracing that curve, perhaps “halfway back up,” he said.

And while each of the experts and operators spoke about the legislation’s importance for the industry, none relayed full-throated enthusiasm on the possibility given the political headwinds that continue to shift on the topic.

Though, they did express that this move provided hope for the future.

“If you think about it, certainly during the pandemic, everybody got a portfolio and … a lot of people … rediscovered cannabis,” Drake said. “And I think a lot of people who rediscovered cannabis during the pandemic would love to have cannabis in their portfolio, but there aren’t a lot of vehicles for them to do it because U.S. plant-touching cannabis stocks aren’t listed on the exchanges.”

“Right now we have a universe of people that will buy stocks, and they will get excited and buy before [legalization or scheduling] even changes,” Brochstein said. “And maybe the universe of people will get bigger because it’s easier to buy on a higher exchange.”

Those who have weathered the cannabis industry know that often the one certainty is uncertainty. For now, we’re stuck with: Only time will tell.

Editor’s note: Associate Editor Andriana Ruscitto contributed to this report.