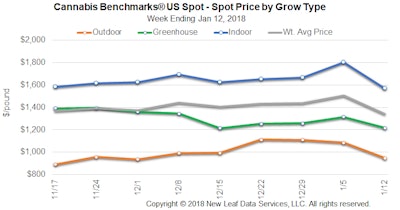

An oversupply of cannabis in the country’s major markets have set national wholesale cannabis prices on a steep decline. The U.S. Spot Index fell nearly 11 percent between Jan. 5 and Jan. 12, according to Cannabis Benchmarks’ market prices, settling at $1,340 per pound.

This is the lowest weekly composite price reported in nearly three years of documenting legal cannabis wholesale markets, according to Adam Koh, editorial director for Cannabis Benchmarks, a division of New Leaf Data Services that provides financial, business and industry data.

“The occurrence of such low rates this early in a calendar year is an anomaly, and is due generally to broad oversupply in the major markets of California, Colorado, Oregon and Washington, which together account for a vast majority of the total volume traded wholesale nationwide,” he added.

The only comparable decline, he said, was a steep price slide in February 2016, when the U.S. Spot Index dropped by more than 12 percent over the course of two weeks when growers in California and Washington released large volumes of supply from the prior year’s outdoor harvest onto the market.

Similarly, favorable outdoor growing conditions on the West Coast in 2017 have led to an influx of outdoor flower in the market.

“In our report for Oct. 13, [2017], we noted an account from a Humboldt County farmer that the region experienced an autumn marked by sunny, warm weather, with low humidity and virtually no precipitation; similar conditions extended to southern Oregon, as well as Washington State,” Koh said. “Subsequently—and even in the wake of severe wildfires that burned large areas of northern California, including in Mendocino County —market participants had been reporting a glut of outdoor flower; yields were high and losses from mold and other pests were minimal.”

As such, Cannabis Benchmarks has been tracking a trend of decreasing rates for outdoor-grown cannabis in Oregon over the fourth quarter of 2017, and has also been analyzing the impact of Washington’s 2017 harvest, which experts in the market say is at least 50 percent larger than 2016’s harvest, Koh noted.

“In California, meanwhile, prices had remained relatively steady, likely due at least in part to significant uncertainty as to market conditions around the opening of licensed adult-use sales that occurred with the new year,” Koh added. “At this point, though, it appears that the dam has broken and the abundance of available product in the wholesale markets of the major western states is pushing down supply side prices across the board.”

Indoor and outdoor prices fell just under 13 percent and greenhouse prices dropped 7.5 percent last week, while the price for medical marijuana fell 11.4 percent, and recreational cannabis prices dropped just over 10 percent, according to Cannabis Benchmarks’ data.

“Indoor- and outdoor-grown flower saw the largest proportional declines, emphasizing that the price slide is due to general oversupply in the country’s major markets,” Koh said. “Seasonality factors are contributing, though, as abundant product from 2017’s fall harvest continues to apply downward price pressure in the West Coast markets.”

The volume-weighted averages for indoor-, greenhouse- and outdoor-grown flower in Washington state dropped below their 2017 lows, Koh noted.

“Overall, current market conditions emphasize that, despite the significant attention commanded by legalization and the opening of new markets, cannabis remains a niche, specialty product that is not used regularly by the vast majority of adults,” Koh said. “While that may change in years to come, the relatively limited current demand for cannabis has been overwhelmed by ever-expanding supply, which has been pushing prices downward consistently in Colorado and Washington State, the country’s most mature regulated markets, [over] the past 18 months.”

California and Oregon have produced an abundance of product, as well, Koh added, but the prices remained steady by the risks associated with businesses operating in semi-legal markets and challenges in efficiency that come from regulatory uncertainty.

“However, the case of Oregon at the current moment—which is seeing growers struggle in a decidedly buyer’s market less than 16 months after the opening of licensed adult-use sales—indicates that increased know-how regarding large-scale cultivation combined with a very favorable growing season can turn a young market on its head in a short span,” Koh said.

The oversupply on the West Coast is expected to continue and exert downward pressure on the market prices for about the next six months as the surplus inventory works through the supply chain, Koh said. With so many cultivators affected, the market could encounter a variety of possible scenarios as growers try to make up for profit losses, he noted. More harvests could be devoted to higher-margin extraction, while some could be diverted to illicit markets, he said.

“While our assessment of the forward market has declined for the six-month horizon, the potential for upstream consolidation in some markets, attempts to recoup compliance-related costs in California and Nevada and ongoing uncertainty regarding transition periods in California, Michigan and Massachusetts are some of the drivers suggesting a case for higher prices in the months ahead, particularly the latter portion of the period,” Koh said.

Images courtesy of Cannabis Benchmarks